I’m Looking for an Exit

Introduction:

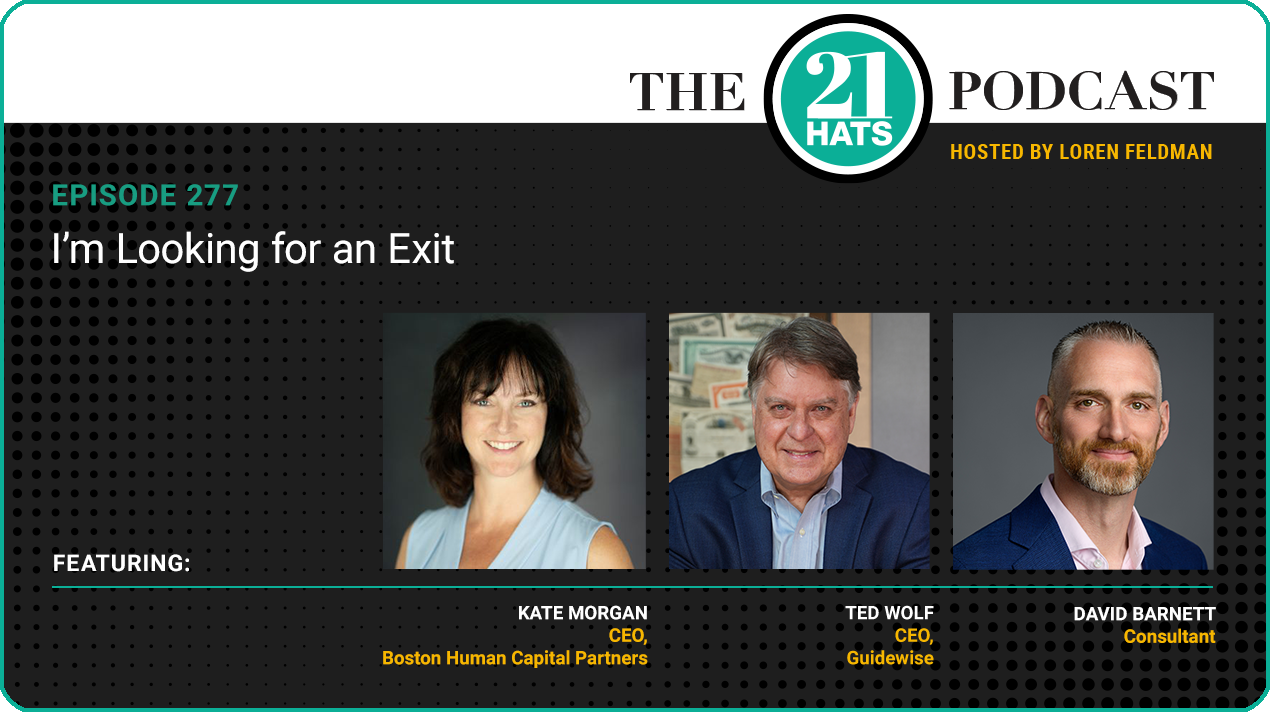

Six years ago, Kate Morgan walked away from the sale of her business just days before closing. Since then, she’s endured some rough stretches, fighting through the pandemic and a slump in the software sector where many of her clients live. She’s managed to stay profitable, and she sees lots of opportunity ahead, but the grind has worn her down. After years of pushing, adapting, and holding on, she says she’s had enough. She believes a strategic sale makes the most sense, and she’s working her network to find the right buyer. This week, she talks through her plan with David C. Barnett and Ted Wolf, two owners who—unlike most—have actually sold businesses and lived with the consequences. They push Kate to think carefully about her options and the pitfalls that trip up so many owners.

Plus: One reason Kate is ready to sell is that she’s recently published a book, and she’d like to devote more time and energy to accepting speaking opportunities. As it happens, Ted has written two books that he’s trying to figure out how to get published. Kate and David compare notes on the very different paths they’ve taken—David self-publishing through Amazon, Kate paying a big fee to work with Forbes Books. Both are quite happy with the choices they made.

— Loren Feldman

Guests:

Kate Morgan is CEO of Boston Human Capital Partners.

David C. Barnett helps people buy and sell businesses.

Ted Wolf is CEO of Guidewise.

Producer:

Jess Thoubboron is founder of Blank Word.

Full Episode Transcript:

Loren Feldman:

Welcome Dave, Kate, and Ted. It’s great to have all of you here. Kate, I gather you’ve come to an interesting decision about your business. Want to share what that is?

Kate Morgan:

So, humble brag, I am a best-selling author, not only through Amazon in multiple categories, but now Barnes & Noble. And what I’m finding is that my business is picking up in rapid step, and as I start to look at where I’m going to spend my time and energy, I’m a little concerned with how I don’t have the capacity to be focusing on both. In order to take on the increasing demand, it will require a lot more heavy lifting. So what I’m doing is, actually I’m considering an exit, but I want to be a little bit more strategic.

So, six years ago, I had an offer, and I backed out because of Covid, and I wasn’t sure if I was going to get my earn out. And here I am at this crossroad, and I’m thinking about how to approach exiting with a very different lens. And in part, that is, I don’t necessarily want to work with a broker. I think my concern with going with a broker is, I know how it works. It’s sort of like, if you sell a house, you’ve got to make sure you’re always available. Otherwise, if you’re not showing your house, your Realtor is going to kind of kick you to the curb. So I don’t want to be in this position where I don’t necessarily think it’s a good idea to bring an owner-operator in. I think it actually would be a great acquisition to pair within a consulting firm or something like that. So yeah, that’s kind of where my head’s at.

Loren Feldman:

A couple of things, Kate: One, you said you’re concerned about your ability to focus on both. And I’m not sure what you meant. By both, did you mean both running the business and promoting your book?

Kate Morgan:

Correct, because you don’t make a ton of money off of books. It’s more speaking engagements and the like. And I literally have not been able to really get any time to start building out speaking modules. I have one, and I want to have five that really support all of my work.

Loren Feldman:

No matter how successful your efforts are in promoting the book, that has kind of a limited shelf life. At some point, that will recede. What do you imagine you would do then, if you, at that point, have sold the business?

Kate Morgan:

Well, I think, a couple of things. I think this has a lot more longevity, because everything in there is not like flashy new things. If you look at the book Who, that’s been out for years, and it’s still a best-seller, right? I’m also looking at this from the perspective of being on the wrong side of 50, and I have a husband who’s going to be retiring. So I’ve done very well financially. It’s not really as much about the money aspect as the time and quality of life and happiness perspective.

Loren Feldman:

Fair enough. You expressed some doubts about using a broker. I’m sure David and Ted will have some thoughts on that. But first, the first time you tried to sell your business and had an offer and came very close to selling it, did you use a broker that time?

Kate Morgan:

I did, and I mean, I’m not knocking that experience. The broker I was working with, she was wonderful. It just wasn’t a very enjoyable experience with having all these tire-kickers come. And the way I’m looking at this is, I realize that loans are hard to get for people. Because I’m not cash-strapped, I’m looking at doing seller-financing. And so, I think it’s actually an amazing opportunity for the right buyer.

Loren Feldman:

And what’s your alternative to using a broker? How are you thinking about getting the word out there and finding that right buyer?

Kate Morgan:

Well, I was thinking about going on this podcast: 21 Hats. [Laughter]

Loren Feldman:

In which case, I get the fee, correct?

Kate Morgan:

I’m sorry my mic isn’t working again. I’m having trouble with my audio. [Laughter] So I have been being a little strategic. I’ve been going out and having—so I’ve had two conversations so far. I’m having a third tomorrow.

Loren Feldman:

Conversations with…?

Kate Morgan:

With other companies.

Loren Feldman:

Prospective acquirers?

Kate Morgan:

Yeah, and the first was interesting, because our model for talent acquisition and HR services, we don’t work on contingency. And because of that, even though a lot of firms have taken big hits, I’ve still remained very profitable. So I went to somebody who has more of a traditional head-hunting firm and retain search, and he was very concerned about it cannibalizing his current business. But to be honest with you, it’s like: Well, maybe it should cannibalize it. Because I was very profitable, where the last couple of years he hadn’t been.

The next was actually working with—so a lot of the accounting firms and payroll companies, they’re starting to look at how to go broader and deeper in their clients. So I do have one conversation that’s already being considered, because they grew the HR side. I think my HR side actually has a lot more legs, and we have a lot more industries that they’re not in. So it could be very attractive to that person. By reputation, that person is not probably a good fit for me, personally. The third, I think, is actually a really good potential fit because they do more business consulting, and they already are trying to do a little bit more in the talent acquisition/HR space.

Loren Feldman:

Dave, what else would you like to know? Do you have questions you would want to ask Kate?

David Barnett:

So first, some reassurances: There’s no hard data about exactly what percentage of businesses actually change hands using a broker or not. But my best guess is like 80 percent of businesses change hands without one.

Kate Morgan:

Oh, interesting.

David Barnett:

The vast majority of business transactions are done without an intermediary or an add-on, BizBuySell, or something like that. And you’re starting off by talking about the tactic of seller financing. Most business transactions involve some degree of seller financing. So it’s great to hear that you’re open to that, but it’s not the place I would begin. Because you’re talking about several different decisions that all come in an order of dominoes, and we’re talking about maybe three or four of the 21 Hats here.

So at the beginning of the episode, you talked about how you wanted to focus on the book and do some speaking and things like that. So I would say that you are choosing a career change, number one. And then there’s the conflict with your existing job. You feel an obligation to that employer because you own that business. So you’re trying to manage that in a smart way, right?

Kate Morgan:

Yeah.

David Barnett:

When deciding to put the business up for sale, then you have to find the right buyer. It’s only after you have a buyer, you’ve agreed on a price, etc., that you can really entertain the decision of: To what degree do I want to finance this transaction? Because that, in part, is going to depend upon who the other party is and what degree of confidence you have in them. Because that hat is actually a banker hat, because you’re literally lending someone money to acquire something of value from you.

And so, these things, I think, need to be taken one at a time, and I mean, you’re not alone. A lot of people make the decision: Hey, you know, if I had the option, I might sell today. But then they don’t take action. They don’t hire a broker. A lot of the people who I work with on the buyer side, they go out and they knock on the doors of business owners, hoping to find someone who’s in that position that they’ve decided, “Maybe it’s time for me to sell,” but they haven’t taken action. So they kind of get a chance to talk to that someone before a broker might.

You seem to have a pretty good idea of who you might want to sell it to. The one thing that business brokers do deliver is they can deliver competition or a profitable, well-run business. So it really depends on the experience you have, for you to go out and talk to a few people you think may want to acquire, and then try to work something out with them, and then later decide to go to a broker if nothing works. You wouldn’t be the first person to go down that kind of path.

Kate Morgan:

Well, that’s good. It’s nice to know that I’m not just crazy.

Ted Wolf:

If I could ask a couple of questions—this is Ted, Kate—I think you mentioned you were in the head-hunting area. Is that correct?

Kate Morgan:

Well, so head-hunting is commission-driven. We’re talent acquisition and HR consulting services.

Ted Wolf:

Okay, can I ask just a couple questions about you?

Kate Morgan:

Yeah.

Ted Wolf:

Where do you get your excitement? What do you find thrilling in a business?

Kate Morgan:

Yeah, so it’s kind of funny. I was actually leading an accelerator program yesterday, and that question came up from the facilitator. And I really enjoy being the thought leader and the authority. I think what has really become a grind is, I’ve had my business for 15 years now, and I’d grown it to be exceptionally profitable, and then Covid hit. And then the PPP loans were kind of weird, because, again, that felt like a felony when they gave you a big lump of money. But we did fine. And then we’re in this situation where the software market tanked three years ago. Well, now it’s come back. It was a feverish stretch.

Loren Feldman:

And that matters because you focus on placing people in tech companies?

Kate Morgan:

Well, again, I hate that sort of narrative. The narrative is: No, we help high-growth, VC-backed companies. That’s our ICP. So we don’t think about placing the people. We think about how we’ll build companies. So yes, the bulk of it was software. Now we’re in life science, and we are also catering to no-tech, low-tech industries. Most people in my industry, they’re super myopic, and they only will work in one industry. And all of those companies tanked hard where we still were very profitable, but now it’s coming back with such a velocity that I have to think about how to rebuild my company to the power it was before Covid. That takes a lot of heavy lifting.

Ted Wolf:

So am I correct in saying, then, drinking martinis on the beach looks a little more attractive to you right now, at this stage of your life?

Kate Morgan:

Oh my gosh. It’s like you’re reading my mind. [Laughter] Yeah, but it’s twofold, right? It’s also setting my team up to be super successful, and giving them more to go with their career. They’re all, you know, they’re young, they’re brilliant, they’re hard-working, so I want them to have a career path.

Ted Wolf:

Yeah. Have you ever heard of the term “quality of earnings”?

Kate Morgan:

No.

Ted Wolf:

Okay, most people, when they sell a business—and Dave, you probably have a lot more information and statistics than I do, but they look at EBITDA and then get the multiple. And then they’ll say, “This is what I’ll get.” And then they take tax considerations in place. “I’ll take my employees into consideration.” And then when they get to the bottom line, they look at it and say, “Wow, I’m not really selling this for what I thought I was on that opening number.”

And then they hit quality of earnings, and quality of earnings is what you’ll go through. And I think you’re probably big enough that they’ll want to go through a quality of earnings exercise with you, and that’s it’s kind of like EBITDA with receipts, meaning prove every single thing that you claim in your business. And they go into extraordinary detail. Most people are not prepared for that quality of earnings exercise in any way, shape, or form, and they haven’t planned and run their business to prepare them for it. So that’ll be an exercise and something that will definitely tax your thinking ability.

Kate Morgan:

I am a huge advocate—so I haven’t heard of that term, but that’s why I was going through the sale before. Like legit, I called off the sale seven days before our close. So the broker was super impressed, because I’ve really run the company so it could be a stand-up operation without me. At that time, when I was running the company, I had so much infrastructure and people in place that I only spent five hours a week in the business. I had actually started a second company, so I’m not really concerned about that.

And because of that exercise, I also know I feel very comfortable in what I’m looking to get, which I’d rather not disclose. And it’s actually interesting, because I think there’s a lot of things that are overhead that an acquiring company could come in and do for a lot less. You know, I have a PEO. If a large company comes in, they could do away with the PEO. So, yeah, there’s lots of opportunities, I think, for a buyer to improve the cash. Like I said, I’m very profitable right now.

David Barnett:

Well, I was just gonna say, where you’re straying, Kate, is into the area that’s sometimes called “synergies” and sometimes called “blue sky,” where you’re talking about how a buyer will be able to make more money with your business than you can. And it could very well absolutely be true, but most buyers are going to sit and think about that. And they’re going to think, “Hmm, I’m the one who’s going to be doing the work to achieve those higher earnings. Why am I paying Kate for the work that I’m going to have to do to achieve those things?” And to Ted’s point, most people I sit down with and go through an evaluation with, they usually end up saying something to the effect of, “Wow, if I just stayed and ran it for a few more years, I’d have the same money.” And they’re all correct.

My big question for you—and you’re talking about your employees and how you want them to prosper and have a great career path and everything—my question is, are there any people there who you could step up and start running more of the day-to-day? Could you get back to that five-hour-a-week sort of arrangement?

Kate Morgan:

No, you know, it’s kind of a shame. I have the best team I have ever had in 15 years, and I’ve worked very hard for the past three years in trying to get them to—you know, they have the owner mindset, but they don’t have the strategic mindset, if that makes sense. So the passion and the brilliance is there for day-to-day, but I struggle even seeing them being really great managers to hire and manage folks.

Ted Wolf:

So if I could ask, I started out years ago, my brother and I, we worked for IBM. We left, we started a head-hunting firm, and then staff augmentation in a technical area. We ended up being acquired by Iron Mountain Corporation. The reason why we got out of the business is we did everything we could do without putting our houses, every asset we have, back on the line with the banks so that we could expand real depth nationally. We were national, but not to the depth we needed to. So it’s near and dear to my heart what you said you were doing, and I certainly understand it.

I would say to you, one of the first things to think about after you make the sale is your identity. Right now, you’re probably wrapped up in the thought strategy, the thought-leader concept, and the book is certainly satisfying that. I can understand it, but I know so many, so many people who have sold their business, and they think they want to drink martinis on the beach. And after a while, that gets boring, and then they just start listening to Fox News or CNN. [Laughter] That determines their life. They go a little stale. And then they ask, and it’s always: How do I replace the adrenaline rush that I fell in love with when I had the business, but at the time, I hated the adrenaline rush? So then they may start doing a little side stock trading, and that’s where they get their excitement. And that’s the biggest formula for disaster, right there.

So think about down the road: What do I want to really do when I retire? Because some people—it’s not this way with everybody—but some people, when you retire, it’s the 800-number to the emergency room, because they just go stale. And they lose their discipline and their edge. Just think about it. But it sounds like, if you want to start this other business, you’re actually starting another business with being the author.

You’re in a startup situation again. They’re hard to do. I’ve done a number of them. You’re going to work harder then than now. I would just ask you to think about and consider: Maybe if I beef up my work aspect, it might go really well from the standpoint of, I get in managers who can run it for me, as Dave was asking, in effect, and saying, “I can have passive income here if I can get the right people.”

Kate Morgan:

Yeah, and see, again I have done very, very well. So I don’t need the lump sum out of the gate, you know? And I don’t even actually mind, because if I have this platform for thought leadership, any opportunities that filter through from my thought leadership to the new company, that I’m fine with. I need to go somewhere.

David Barnett:

Kate, how important is your reputation and people’s awareness of you, and what you’ve done in the book and everything? How important is that to your business?

Kate Morgan:

So yes, people know Kate Morgan in the industry, but I don’t do the work. My team is so good that they’re actually helping to draw in the new business. They’ll say, “Hey, I know you’ve worked with XYZ company. I’m reaching out.”

David Barnett:

How important is it to your new author and speaking business to be the owner and associated with your recruiting business?

Kate Morgan:

Not necessary. I don’t believe so, anyway.

David Barnett:

Okay, but you’re saying that right now is a great opportunity over the next decade for your business to grow because of what you see upcoming.

Kate Morgan:

Correct, and I’m also seeing that the market is actually coming back so quickly.

David Barnett:

And there’s no one in the firm who you think could take your role? So there’s another option, which a business broker would never lead you to, but I’m going to share it with you here. And that’s because business brokers want transactions that close, so that there’s a price and they can charge a commission, etc. So the other option is for you to go find the younger Kate or who is out there already with their own business that could be smaller than yours, who doesn’t see an acquisition of your company as being possible, but you let them bring their firm in and become your partner. But that person becomes the day-to-day managing person.

Kate Morgan:

Yes, and that’s exactly how I sort of envision this, but not necessarily in my space. I think there’s so many adjacent companies, firms, that this becomes an add-on, and it could be really attractive.

David Barnett:

Are they going to be able to run it? Would a bunch of accountants be able to run your business?

Kate Morgan:

Actually, yeah, if you have a really strong operator. The team, we have all of our training modules. We have our processes all really well-documented. So yeah, actually, I don’t think that that would be a problem.

Loren Feldman:

Kate, if that’s the case, it sounds like it should be a possibility to bring in somebody from the outside to take over your role and let your team run with it, with some training and guidance. Is that something you would consider?

Kate Morgan:

No, because it still requires a lot of energy and time that I really don’t feel like managing. I just don’t feel like managing it.

Ted Wolf:

Yeah, Kate, I have worked with a lot of people to prepare them for an exit, and a big part of that is just honesty. And what I’m hearing is, you’ve done what you wanted to do with the business. Now, you’re ready for the next episode, and you’re kind of burned out. You’re losing the flame.

Kate Morgan:

You got it.

Ted Wolf:

So you’ve got to be honest with yourself on that, first of all. And number two, then say, “Okay, what am I going to replace it with?” And the book, the tour, you have some financial independence. I would just ask you to think about financials from the standpoint of: I know many people who have sold a business, and they lost what they earned on it. And we don’t know what’s going to happen with business in the future, with AI and all those other things that are going on. So just refortify and re-examine that whole financial aspect, number one.

Number two, your identity, your internal operating system. You certainly seem like you’re an idea person. You’re certainly smart enough, to some of the things that you said about your business, I understand, because of having a very similar business. I think you get all that. It comes down to, okay, are you ready to go out and do that startup thing? And the startup thing might be, “Hey, I only want to work 10-15 hours a week. And that’s all I want to do, and that’s all I need to do.”

And if that’s going to get your juices going again and keep you young at heart and mind, then do it. But make a decision, and then make the decision right. Don’t worry about the “right decision.” I know so many people that go through—Dave, I’m sure you’ve seen this—people who are agonizing over the last quote-unquote million dollars in a negotiation. I mean, I know somebody was offered $50 million for their $35 million business, and they didn’t accept it because they wanted $51 million. And they lost the entire deal.

Kate Morgan:

[Laughter] You gotta love people.

David Barnett:

I always say that the top reasons people want to sell a profitable small business: the very number one reason is burnout, boredom, and fatigue. I just call it the state-of-mind bucket. And then there’s divorce, poor health, the need to relocate, and retirement. And I think it’s great, Kate, that you’re honest and understanding that you just don’t want to do it anymore. I think if you can’t work out a good deal with the people you’re talking to, I don’t necessarily think it’s a business broker that you need, but probably more of an M&A mid-market advisory firm.

Because what I think you would benefit the most from would be somebody who would actually sit down and create a target list of possible firms that would have great opportunity in acquiring your business. And that could be a firm on the other side of the country. It could be an international company that wants to have an American footprint. It could be anyone, but it’s not just a business broker who’s going to put a listing on the internet. You want someone who really takes a strategic point of view and finds the right fit to acquire your business. It sounds like your business would be a great expansion for someone, who might be big somewhere else, who wants to come into your marketplace.

Loren Feldman:

Kate, you’re making very clear that you want to do this and you want to do it now. Does that mean you’re willing to accept pretty much any price to get this done?

Kate Morgan:

No, no, no, no, no. I’m a big disciple of Annie Duke, and her book Quit, so I know exactly what I need. And, you know, I think it’s a very attractive deal. I think, to my daughter’s credit, she’s like, “Mom, you’re undervaluing yourself.” But it’s because of some of these things that you guys have already pointed out that I’m willing to take the hit.

Ted Wolf:

What I would say to you also, Kate: Entrepreneurs are usually very highly-driven, emotional people, and maybe have a touch of ADD to it. [Laughter]

Loren Feldman:

A touch.

Ted Wolf:

I’ve met few owners, very few owners, who were not ADD prone. I would say to you, if that’s where your emotions are, and that’s where your drive is, and you’re getting that meaning, and that passion is starting to come out where: Okay, I’m a meat-eater, man. I’m going to get on that street and I’m going to tear it up, whatever I’m going to do, and I can’t wait to get started. You have to listen to that.

Kate Morgan:

Yeah, yeah.

Loren Feldman:

I want to shift to talking about books a little bit, but first, just one last thing, Kate: Do your employees know what you’re thinking?

Kate Morgan:

No, no, but it was kind of funny. We had our kickoff meeting earlier this week, and one of the guys who’s been with me for 13 years, he’s like, “What are you thinking about, like, an exit?” Because I did open up that I was going to sell six years ago. And so, I just kind of left it as, “Yeah, for the right price.” But I don’t want to cause them any sort of anxiety or anything like that. I think they would trust me, but I don’t want this to be a distraction.

David Barnett:

It’s interesting that you bring up the employees, because there are different stakeholder groups in the business. Obviously, there’s the owner, there’s employees, customers, etc. And one of the big reasons why business sales are typically secret—you know, it’s completely confidential—is because of the impact that simply the state of being for sale can have on the different stakeholder groups. Customers may worry if there’s an impending change of management.

But when it comes to employees, we know that the vast majority of people live paycheck to paycheck. And they need their income. And if people worry at all that there could be some impact on their employment, if they worry that the new owner might not like them, or maybe the business is really for sale because it’s not doing well—or maybe Kate might just close it down if she can’t find the right buyer. Or maybe the new owner has a cousin who’s going to come take my job. These are all reasons why people become nervous when they work for a business that’s for sale. And the best employees you have always have employment options. And so you know these people pretty well, because you work with them, but that’s typically some of the worries going through an owner’s mind when they think about selling—and why the whole business-for-sale marketplace is generally a secret market.

Loren Feldman:

All right, so let’s talk about books. This whole thing with Kate was driven, to large extent, by your success in writing a book. Ted, you’re interested in doing something similar. Tell us what you’ve been thinking about here.

Ted Wolf:

Well, I actually wrote two books, business books, and I am—

Loren Feldman:

Published or not published?

Ted Wolf:

Not published. Have them written, and I’m sitting back, and I’m saying, “Okay, I don’t even know where to go from here.” This is a totally new domain to me. I don’t know about it. I don’t know what to do, and I’m not sure where to go. I know there’s tons of people out there who say, “Well, we’ll ghost-write your book, and then we’ll help you publish,” or whatever. I’m not looking to become, you know, on The New York Times Best Seller list. I’m using it as a vehicle to begin building referrals, build the practice of my business, the current business I’m in now. But I don’t even know where to start, to be honest with you.

Loren Feldman:

Well, Kate and Dave have both been down this road, although they’ve taken very different approaches. You’ve both talked about them a little bit here. Dave, why don’t you tell us how you went about publishing a book.

David Barnett:

Yeah, I used Amazon’s, what they call Kindle Direct Publishing. And basically, you write your book in Word or whatever you want to use. And then, I think the first time I did it, I actually downloaded a template from them, which was basically just a blank book with the margins and everything already set. And you set up your book and make sure it looks nice on your computer screen, and then you upload it, and they create a PDF proof. The first few books I did, I hired freelance artists off of the different freelance websites to create covers for me and stuff, and then I just promoted them myself.

And I never really looked to create the next best seller. I was more or less looking to create tools that would help me in the sales for my business and give me credibility. And they have ended up being incredibly great sales generators. My first book came out in 2014. I’ve learned, since that time, that there are a lot of people who, when they have a particular problem or question, they go looking for a book on the topic. And if one of my books addresses that topic, people will buy it. They’ll read it. And then sometimes they’ll reach out, or at least they’ll join my YouTube audience, or come into my sphere in some way, and then I’ve got a chance of doing business with them.

Ted Wolf:

One quick question, if I could ask you, Dave: Why’d you choose a book versus an ebook?

David Barnett:

Well, so, back in 2014, not many people knew about an ebook, and they are all available on Kindle, and most of them are also available on different websites I run as PDFs, too. And all of them are now also available as audio books as well. And I’ll tell you, audio books are important, because audio books seem to be far more popular than ebooks and print books combined.

Ted Wolf:

And are you doing the audiobook yourself through Amazon? Or are you taking a different route on that?

David Barnett:

The first books I did, I recorded them all myself, and It’s an incredible amount of work. It’s unreal. [Laughter] Basically, I used a recording app on my iPhone and the microphone I’m talking to you on right now. So it was a better quality mic. But then I hired a person—again, a freelancer, who’s a sound engineer—who then prepped them all according to Amazon’s specs. It’s called ICX.

But now they’ve got a new AI tool. And so the last two books that I updated and put out, I tried their AI tool, and it lets you choose different voices. And I chose sort of a generic, accented voice that I thought was kind of proximate to mine. And my thought was, “Hey, I’m going to offer this for sale, and if people return it because they don’t like it, then I’ll know that it doesn’t work.” And that was six months ago, and people are buying it and nobody’s returning it. So I think the technology has gotten to the point where people are accepting it.

Loren Feldman:

And what did this process cost you, Dave?

David Barnett:

Oh, just my time and whatever I paid freelancers.

Loren Feldman:

There was no fee to Amazon?

David Barnett:

The printed books are print-on-demand, and they’ve got these machines in different places around the world. So if someone orders a book in Europe, it gets printed in England. And if someone orders a book in Canada, it’s printed here or in the States. I think there’s a couple of different spots. But there’s no inventory, so you don’t have to have a garage full of 10,000 copies. And of course, the electronic ebooks and the audio books, it’s all electronic files.

Loren Feldman:

Before I ask Kate about her approach, Ted, why don’t you tell us, what are the topics of your two books?

Ted Wolf:

Well, the one book is how to prepare a business for an exit, or putting in a succession plan, or to go out and get funding. And the reason for that is because I think there’s a lot of individuals who are in this—”I’m not sure if I want to sell. I think I do.” Dave, you might know this, but my last statistics that I found was about 30 percent of businesses that want to be acquired actually get acquired. Everybody doesn’t think that way. They think, “I’ve got a great business. I’m making profits. Somebody’s going to buy this business.” But it isn’t that way.

So that was one book, and the other book is a methodology on how you would actually manage change within your business. Every company is going through massive change. And a big part is people’s resistance to change, and that’s what the second book is about: How do we get people to adopt change and start using it to produce work? And change from technology, change from a sale, change could even be promoted to a new position. So they’re the two topics of these two books.

David Barnett:

Well, Ted, actually, the business-for-sale website, BizBuySell, publishes a report every quarter, and the last couple that I saw were pretty consistent. About 80 percent of the businesses that get listed there on that website do not sell. So it jives, and I know that that runs the gamut from the very smallest of businesses to some in the mid-market, but it jives perfectly with what you’re saying. And there’s a big difference between a business that puts money in someone’s pocket versus a transferable going concern.

Ted Wolf:

Yes, exactly, and that’s exactly what I address.

Loren Feldman:

Kate, you took a different approach. Can you tell us how you published a book?

Kate Morgan:

Yeah. So I worked with Forbes, not the Authority group, but the actual Forbes—

Loren Feldman:

Well, let’s be clear. There’s a company called—I forget exactly what the title is, but they have a Forbes imprint there. It’s not the actual people who work at Forbes magazine. Correct?

Kate Morgan:

Well, it’s Forbes Books.

Loren Feldman:

Right, and this company, which is based in Charleston, South Carolina, has a deal with Forbes, the magazine publisher, and they publish books under that imprint.

Kate Morgan:

Correct, so that’s like the upper echelon, when you look at it. So I went that route, because there is the direct correlation to Forbes, and I also get to have featured pieces on it. So it’s not just publishing through that organization, it’s all of the other things that come along with it. Because the one thing we did back out was doing PR. They couldn’t figure out PR for me, but, yeah, I spent a boatload, and it has been—

Loren Feldman:

You’ve told us before how much that was.

Kate Morgan:

Yes, it was $200,000, but I’m super happy with it. I wouldn’t change a thing. Like I said, I’ve been on 15 different categories as a best seller on Amazon, and I was able to get the badge because it was also organic, not paid. I am also now, I think I was number five on Barnes & Noble.

Loren Feldman:

And just to be clear, Kate, you paid $200,000 for this, but you didn’t hire a ghost writer. You wrote the book yourself, right?

Kate Morgan:

Correct. They did give me my book coach, who—my God, if I didn’t have her, I’d have a pamphlet. I wouldn’t have a book. Because there’s so much unconscious confidence that I have, and she’d be like, “No, you have to explain this.” And so she really helped make it what it is today.

Loren Feldman:

So Ted, an obvious question: You’re a big AI guy. Have you asked ChatGPT, or Claude, or anybody else, what the best approach to publishing a book would be?

Ted Wolf:

I asked it, but it gave me mixed results, in my mind, to be honest with you. I tend to go toward Dave’s avenue. I’m not looking to become a best seller. I’m looking to help people, because, you know, when you want to be acquired, generally, preparing your company takes three to five years to do that on average. So I’m looking forward to build business more than I am becoming a best seller. I’m just in my own mind at that divide right now. I’m not sure. I don’t have the conviction to go one way or the other.

Loren Feldman:

Is there anything that we can help you with as you figure out how to proceed?

Ted Wolf:

Well, Kate, you went to Forbes, and that’s a well-known name, kind of a marquee, if you will. There are so many other people out there who say, “This is what you need to do.” And I don’t have the confidence to make what I’ll call an informed decision, because I’ve never done this before. So my first dip in the water would probably be following what Dave said and following that whole Amazon route, because I’m not looking to it for income. But on the other hand, I’m looking at it, though, and saying, “What doors will this open for me that I could take advantage of?”

So I want it to be a door opener in multiple ways. And I guess I’ve learned in my business, the best clients that I have, I get from referrals from other people. So I want to talk to other people who have done it, such as the two of you. Kate and Dave, thank you for your input. I want to be able to talk to you because you’ve done it, you’ve been down there, and you’re the guide. And that’s what I need to be able to get an informed decision, I think.

David Barnett:

You know, a book like this could very well be a good money maker for you. You just have to figure out who you could sell it to in volume. So, for example, helping someone get their business ready to sell would be something that might be interesting to a business broker trying to develop a pipeline of potential listings down the road. And so, maybe you could be selling them by the box full to people like that. Really, it’s what you want to make of it.

Loren Feldman:

Dave, I’m an editor, so I’m inclined to believe that every writer needs an editor. When you published the book yourself and took it to Amazon and took your Word file and put it in, had you written it yourself and then submitted it to someone else to help you, to review it, to give you feedback, or did you just do it all completely yourself?

David Barnett:

I had a series of editors who helped me over the course of time. One of them was my good buddy, Aaron, who was the editor of our university newspaper, and who really doesn’t know a whole lot about business or acquisition. So it was great, because he was from outside of the space, so when he pointed out that things weren’t clear or he didn’t understand what I was talking about, it made for some really great edits that I thought improved a couple of the books quite tremendously.

And then as my online audience grew, I actually had people who would send me messages saying, “Hey, if you want an editor for your next book, I’d be more than happy to help out.” And so, a couple of the more recent books have been edited in that fashion, and I think it’s been a very helpful part of the process.

Ted Wolf:

What I did for editing, honestly, I used AI. I wrote the book, and then I fed it into Claude, and then I fed it into ChatGPT, and I asked them to be the editors and come back with advice, instructions, and things like that. I can’t compare it against the human, because I didn’t have a human actually edit it, but it gave me excellent feedback.

Loren Feldman:

Kate, did you use AI at all in your process?

Kate Morgan:

Nope, no. I use AI quite a bit throughout my workflow of my day, but there was one point that I did try to use it—more for kind of just restructuring my thoughts—and it was junk.

Loren Feldman:

We’re just about out of time. One last question, Kate. I know from following you on LinkedIn that you managed to get your book on a billboard—your book and your face—on a billboard in Times Square.

Ted Wolf:

Congratulations.

Loren Feldman:

Was that part of the $200,000 fee? Or how did that happen?

Kate Morgan:

No, no, no. That was a nice little add-on gift that they gave me.

Loren Feldman:

So they just did that for you?

Kate Morgan:

Yeah, it’s a little bit of a story. They lost my audio recording, and they felt really bad about it.

Loren Feldman:

The one that you’d worked really hard on creating?

Kate Morgan:

Yeah, it was a pretty big oops. And to be honest with you, like, I got my royalty statement. I’m pretty sure it didn’t help my book sales, but I will tell you: My ego? Through the roof.

Loren Feldman:

You don’t think the billboard had an impact on sales?

Kate Morgan:

I don’t think so, no—not from what I’m really seeing. I mean, there was a big uptick, but they were doing a big promotion on the ebook, on the Kindle version. So I think that was just, again, more organic growth.

David Barnett:

I think the point is to get your photo taken in front of it, isn’t it? Get it framed, and put it on the wall? [Laughter]

Ted Wolf:

As you drink that martini on the beach.

Kate Morgan:

You got it.

Loren Feldman:

All right, my thanks to David Barnett, Kate Morgan, and Ted Wolf. Really appreciate it, guys. Thanks for sharing.