Do You Have a Healthy Relationship with Your Bank?

If you are one of your bank’s biggest loans, you are too big for your bank. But you also want to be at a bank where your account matters.

By Ami Kassar

In light of the recent bank failures, many business owners and entrepreneurs are wrestling with questions about their banking relationships. In a bumpy economy, having a healthy relationship with your bank or credit union is more important than ever.

Last week, we assembled a group of experts for a webinar on how to think through your banking strategy in the aftermath of the Silicon Valley Bank collapse. (You can watch the entire webinar.)

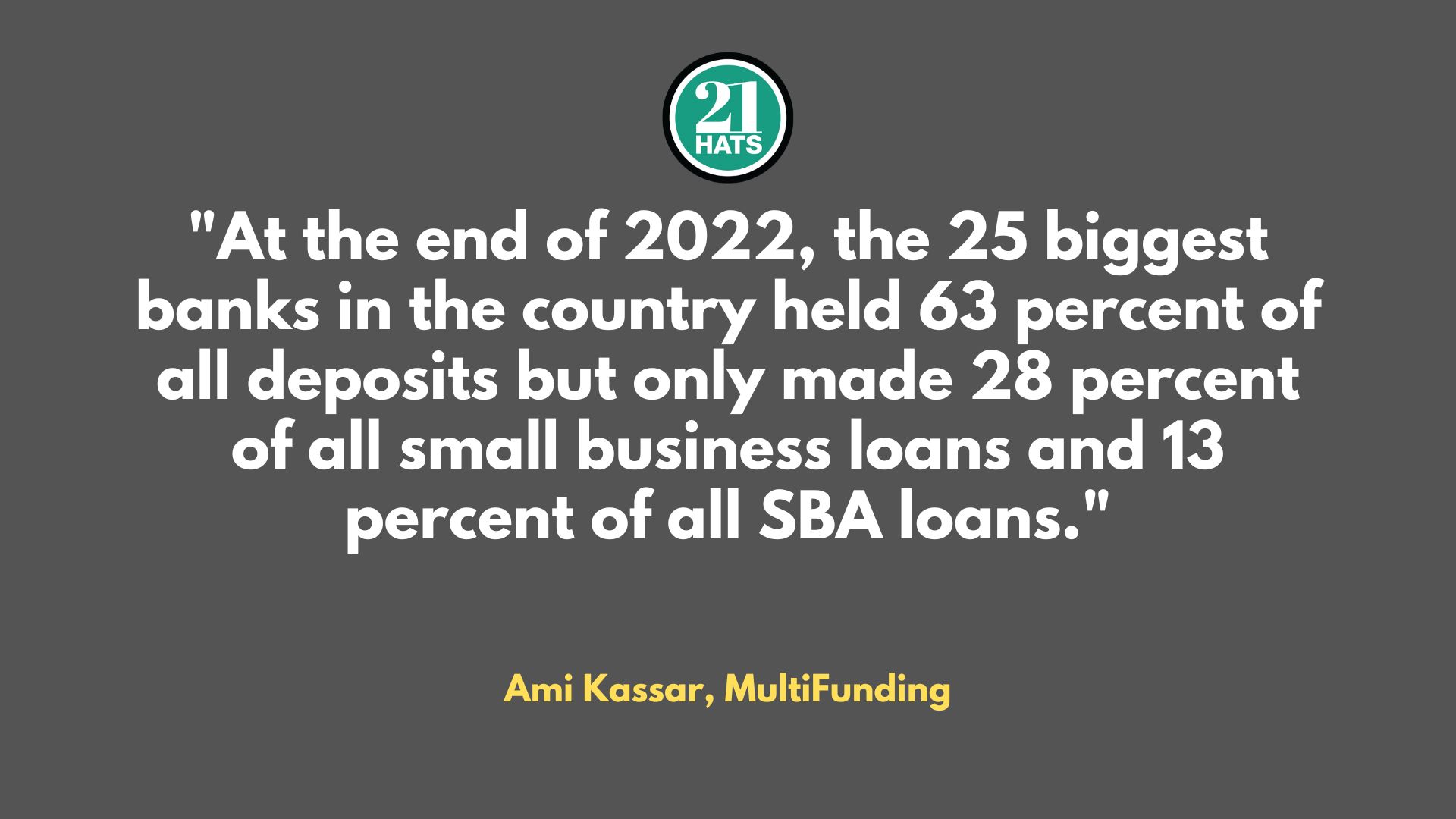

One of the most important points we made in the webinar is that running to big banks is not a winning idea. At the end of 2022, the 25 biggest banks in the country held 63 percent of all deposits but only made 28 percent of all small business loans and 13 percent of all SBA loans. With all their bureaucracy, these big banks are not structured to understand the needs of entrepreneurs and business owners. Yes, they will take your deposits, but will they be there for you if you want a loan or a line of credit?

Entrepreneurs and owners need a healthy banking ecosystem to thrive and survive. If the banking industry becomes like the airline industry, with only about a half-dozen choices, our interests will not be served. We don’t want customer service to wane and make it difficult for owners and entrepreneurs to get much-needed individual and personalized attention.

Erich Buckenmaier and Tom Smith joined the webinar to give their professional takes on protecting and maximizing your deposits. Buckenmaier, managing director at IntraFi of Richmond, Virginia, explained how his company offers several programs—CDARS (a CD option) and ICS (a cash service)—that help businesses access greater FDIC coverage.

“Essentially, what CDARS and ICS are doing for you is what you used to do for yourself,” he explained. “Rather than you spread your money out among a multitude of banks, you now can bank at the local community bank that you know and trust, have them put their money into our network, and we will build you a portfolio of either money market accounts, checking accounts, or CDs. And because those funds are always in increments less than $250,000, you are always in a fully FDIC-insured environment.” CDARS and ICS are available through nearly 3,000 banks.

Smith, first vice president of First Internet Bank, based in Fishers, Indiana, encourages people to take time to review their accounts and then consult with their bankers on new options to maximize their earnings. Your bank may have innovative products and services that save you time and money, which may be as important as the interest rate in many ways. Some examples are a remote deposit scanner and same-day ACH.

It is also essential to find a banker you consider a trusted advisor. “Don’t always assume that when your banker calls you, they’re just trying to sell you another product,” he said. “Think of that relationship much as you would think of a relationship with your attorney, or your CPA, someone that’s a consultant and will offer valued advice.”

As you think through your banking relationship, here are five suggestions to consider:

Check the Finances of Your Bank

A healthy relationship starts with a sound financial institution. There are online resources to check on your bank or credit union, including Weiss Financial Ratings and Bauer Financial. These sites take a lot of detailed information from the FDIC and break it down into a grade or star rating.

Build Relationships Across Your Bank

It’s essential to have relationships with your business development officer and others across the bank in case of emergency. Plus, business development officers often come and go. So you need to know more than one person at your bank.

Be Transparent

Business rarely ever goes in a straight line. So if and when you see an issue on the horizon, it’s always better to get ahead of the curve with bankers and not take them by surprise. Your banker can often help you solve the problem if you get there early enough.

Stay in the Bank’s Sweet Spot

How do you compare to the other businesses your bank services? If you are one of their biggest loans, you are too big for your bank. But at the same time, you want to be important to your bank and not just a speck. Your account should matter to the bank.

Make Sure You Have Access to Credit

Every business should have a line of credit for seasonality, working capital, and emergencies (I recommend that your line of credit represent 10 percent of your annual sales). And more often than not, the bank that issues your line will insist on your deposit relationship. So before you run to give a bank your deposits, make sure they are willing to provide you with a healthy line of credit.

Ami Kassar is CEO of MultiFunding.