Oh, No! They Accepted Our Offer

Introduction:

This week, in episode 70, Laura Zander, Diana Lee, and Dana White all share big news. Laura tells us that she and her husband/co-founder Doug put in a bid to buy a building for their business in Reno—and she’s not sure how she feels about the fact that their offer was accepted. Diana explains why she’s decided to pay a fortune to take over space vacated by glitzy magazine company Condé Nast in Manhattan’s Freedom Tower, a move that required her to put down a $2 million security deposit. And Dana tells us that she’s had preliminary conversations about opening Paralee Boyd salons on U.S. military bases around the world, which prompted Diana to encourage Dana to start vetting investment banking firms: “I’d be like, ‘Here’s the contract with the Army. Give me the money so I can scale this out.’”

— Loren Feldman

Guests:

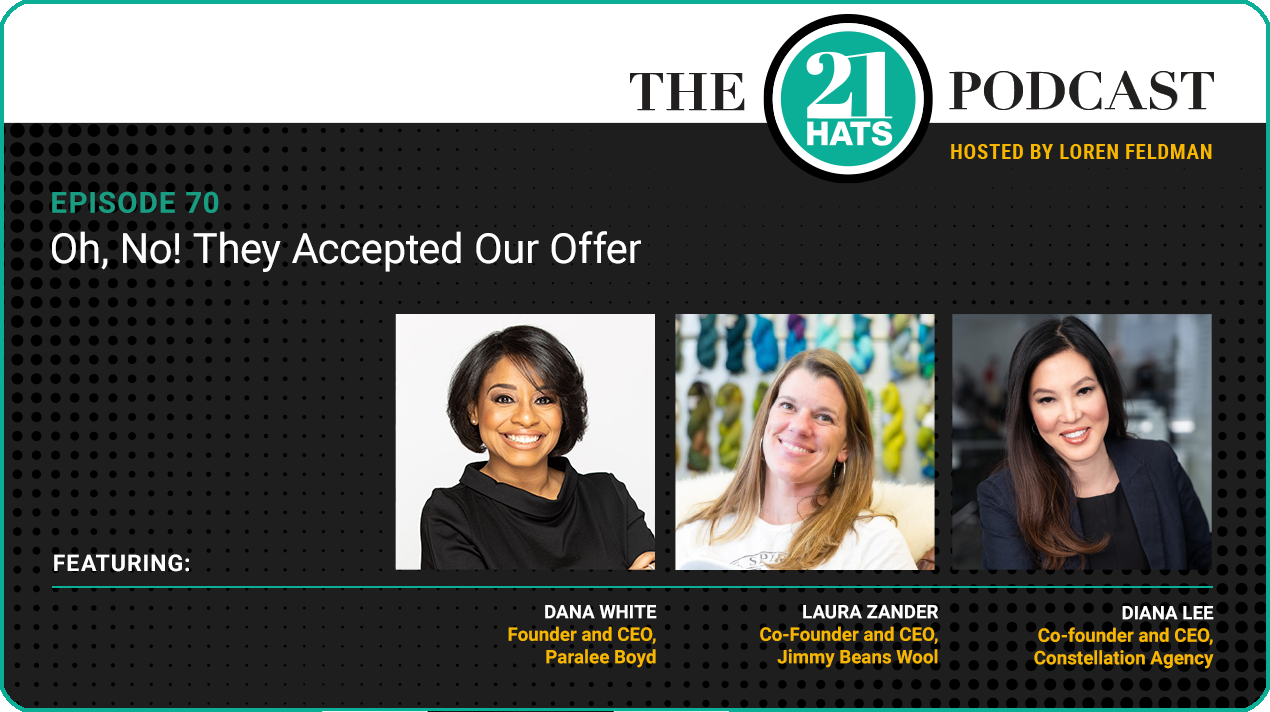

Diana Lee is co-founder and CEO of Constellation Agency.

Dana White is founder and CEO of Paralee Boyd hair salons.

Laura Zander is co-founder and CEO of Jimmy Beans Wool.

Producer:

Jess Thoubboron is founder of Blank Word Productions.

Full Episode Transcript:

Loren Feldman:

Welcome Diana, Dana, and Laura. Great to have you here. Thanks for coming back, Diana. Glad we didn’t scare you away last week.

Diana Lee:

Thank you, Loren, for having me.

Loren Feldman:

Of course. I know we still have lots to learn about how you built Constellation Agency, and we’re gonna get into that. But I want to catch up with Dana and Laura first. Laura, in particular: I heard a rumor about you. You might have some news. Is this true?

Laura Zander:

Did Jay tell you?

Loren Feldman:

He did.

Laura Zander:

I’m not sure that I want to say anything—not that I think my landlord is going to be listening, but I don’t know. Yes. No. Did I sleep well last night? Not really. I had anxiety dreams all night—like, all night. I dreamt that—not that it matters what I dream. Yeah, we may have news. We’re working on it.

Loren Feldman:

Can you give us a hint?

Laura Zander:

Our lease is up in March, and Reno is going through the roof—the real estate market. And it’s been this way for years. We have about 20,000 square feet, and we like our spot okay. You know, it’s fine. But last year, we’d been looking at buying a building in Texas and that was a traumatic experience that did not end well.

Loren Feldman:

But wait a second. It did end well in the sense that you tried to buy a place, you wound up leasing, and you like the place, right?

Laura Zander:

Yes, so I think that everything happened the way that it was meant to happen, and that we’re in a good spot. We had been looking at buildings about two years ago. We thought we were going to buy this Texas business, and we’d considered moving it to Reno, so we were looking for buildings that could house both businesses and just couldn’t find anything. Everything was so expensive compared to what we thought it should be, I guess.

Anyway, so this broker sent me a note about a week ago—10 days ago—and was like, “Hey, there’s this building on the market that I think might be a good fit for you. You’re about six months out from your lease expiring, or nine months or whatever.” She’s like, “The market’s not softening here in Reno, and there’s no vacancy.” Like the vacancy rate right now is, I think 2.7 percent. Anyway, so we went and we looked at this building, or I went and looked at it, and I’m like, “Okay, it’s about the same size as what we have now.” It’s neat, it’s quirky, it’s got a bunch of build-outs that are kind of weird.

So then I took Doug and Shannon, our general manager, kind of fully expecting them to just be like, “Yeah, I don’t know. I don’t think so.” And they loved it. And so I’m like, “Crap.” So we put an offer in, and then last night, the owners of the building who had owned the business—and they sold their business about two years ago and now that business is being consolidated into another location. And so now they have this empty building, and they’re selling the building.

Anyway, so we got a draft of a purchase sale agreement last night, and I’ve been talking to the banker for about a week since we put the offer in. I actually just sent him a note this morning, and I’m like, “Okay, I had anxiety dreams all night last night. Like, I can’t go through this again.” I said, “I guess I’m just a brat. I’m used to getting what I want.” And it was really traumatic to try to get these loans last year and to be denied a couple times. Like, it really messed with me. I didn’t realize how much it messed with me until now. I’m really gun shy. So anyway, we may buy a building. We’re pursuing it.

Loren Feldman:

What’s the anxiety about?

Laura Zander:

Oh, god, it’s so funny you should ask. I sat on my yoga mat for about 30 minutes this morning trying to figure out what I was anxious about. Two things: one, getting denied again. Going through this whole process, all the work that it takes, all the distraction, for the next 60 days, and then at the very end the bank saying, “Haha, no, we’re not going to fund you. We won’t give you the loan.” That’s one part of it. And then the other part, it’s just that the market is so hot here, and so I’m really nervous that we’re buying at—or we would be buying at—the top of the market, and that we would get burned. And so if you want to get all therapy on it, I think I’m worried that, in five years, I’m going to feel stupid, or I’m going to look stupid.

Loren Feldman:

I can’t think of very many situations where a business owner has bought the building and regretted it five years later. Do you know of anybody who’s been through that?

Laura Zander:

You know, that’s a good data point. Doug and I have been talking through all the scenarios. His fear is that something will happen with the business, and we’ll have to close the business, and we won’t be able to afford the building, and the market will have crashed. And so we’ll lose a ton of money, because we’ll have to sell the building when the real estate market crashes. What are the odds of that happening? Not super high, but other than that, he’s super comfortable with it. So if he’s comfortable with it, and Shannon, our general manager, is comfortable with it and thinks we can run the business out of it, then I’m good with it. Then it’s just a case of me still having been upset that I got told “no.” I don’t like being told “no.” I’m an only child.

Dana White:

Can I be the Jay? Can I be the Jay person on the phone today?

Laura Zander:

You can, but you know, I have your cell phone number and I’ll text you later.

Dana White:

Laura, Laura, Laura, you’re killing me. What are you talking about right now, Laura? I mean, you’re so used to having everything your way that you can’t say, “No”? Look, you have an opportunity in front of you, Laura. And you’ve got to decide if you want to do it. What is it that I always say? I always say, “One: it is what it is.” Right now, this building, the market—it is what it is. What else do I say, Laura? I say, “Two: deal with it.” You’ve got to deal with it. What if the sun burns your building up? What if there’s a flood in Reno? There are all these things, but there’s never a reason to regret buying commercial property. I bought commercial property 20 years ago, and I’ve made four times—

Laura Zander:

And I’m a genius!

Dana White:

And you know what? I’m set. My kids are set. My grandkids are set. What I’m telling you is: IOt is what it is. You’re dealing with it. Third thing, you’re operating with a good and noble purpose.

Laura Zander:

A noble cause!

Loren Feldman:

Dana White, ladies and gentlemen. Dana White.

Dana White:

You’re making good yarn. You’re doing good things. You’re dying good yarn. You just overhauled your staff. You’re ready for this! You know what my fourth thing is: I’m not going to say the expletive on the air because I don’t want Loren to get any people calling him back and saying, “Hey, that offended me.” But you know that it’s, “Get out of my way!” You’ve got to move forward. So what if you get rejected by a bank? You go to another bank. You get rejected by that bank? Go to another bank. Keep going to the banks until you get what you want. That’s all I’m gonna say. [Laughter] Jay just took me over!

Diana Lee:

You guys are great!

Dana White:

Jay just possessed me and spoke!

Loren Feldman:

Diana, let me ask you, I believe you’re in the process of moving your office. I think you’re going to lease in your new location. Did you consider buying?

Diana Lee:

So Loren, this is really interesting, because I’ve just gone through six months of pretty much investing so much time and energy into moving our offices. So we actually took the Condé Nast space on the 21st floor, and we’re moving to close to 50,000 square feet—

Loren Feldman:

The 21st floor of…?

Diana Lee:

Condé Nast, in One World Trade Center in the financial district. So I just went from a B building in New York to an A building, and the views are spectacular. I mean, you can only think that Condé Nast would have done an amazing job on their property, so it is probably the most beautiful office I’ve ever seen in Manhattan. It has been our ninth move in the last five years. And each time, it gets a little easier, because you realize that you can do this. It was funny what you were saying, Laura, because I’m leasing it right now. But I kind of went through the same thing you did—a little different, in the sense that now I have to prove to everybody that we could actually afford the rent and going into this spectacular space. And so when you have numbers that are doubling year over year, but they’re still looking at you saying, “Are you really going to ever be the size of Condé Nast one day? Should we actually take a risk on you?” I took a formal meeting with them, the decision makers of this. And I said—

Laura Zander:

Who is “they?” Sorry, are you talking about the bank?

Diana Lee:

I actually am leasing the space directly from Condé Nast.

Laura Zander:

Ohhh, okay.

Diana Lee:

Yeah, I’m still, at this point, self-funded. I have not taken any money at this point, and so I have to prove to Condé Nast, as well as my bankers, right. I had to put up close to $2 million in a security deposit going into this. It’s an astronomical amount of money to freeze up. And the question is, “Do you do a bond? Or do you actually freeze up this money?” And I lost sleep thinking about it. But at the same time, I said, “You know what? I really don’t believe in having debt. I’m debt-averse.” I really wanted to just put the security down, and that’s what I ended up doing.

Laura Zander:

So if you have no debt, what’s the bank?

Diana Lee:

In the very beginning, when we started Constellation, nobody would give me a loan—just like you—or a credit line. So for the first two years, there was nothing. But now, I do have lines of credit.

Laura Zander:

Oh.

Diana Lee:

Yeah, and I like to draw from them. However, I like to also pay them off at the end of the month, because I don’t like debt, and I don’t like having to pay interest. So if I can, I try to stay away from it, I’m one of these people that, if I get a 15 percent discount to pay the whole year upfront, I’d rather do that.

Laura Zander:

Oh, sure. Yeah, we operate the same way.

Loren Feldman:

Diana, I have a question for you about that. But first, Laura, has this had an impact on you—either Dana’s Jay impression, or Diana’s explanation of her experience? What does it leave you thinking?

Laura Zander:

“It is what it is” is a really great point, Di-Jay, Dana-Jay. I was trying to think about that, and something that somebody said to us years and years and years ago about houses—because it was kind of a similar deal when the market gets real hot—we’ve got to live somewhere, and our lease is up in March. And the monthly payment on this loan—even though I feel like the building is too expensive—the monthly payment on the loan, given the low interest rates, is still going to be lower than what we anticipate our new rent to be. It just is what it is. And we’ve got to live somewhere anyway, you know? So it’s just scary. It’s really scary.

Loren Feldman:

All right, Diana, my question for you is: Why did you want to have such a special space? Why do you need the most beautiful offices you’ve ever seen? I can understand Condé Nast wanting that. What does it do for Constellation Agency?

Diana Lee:

It validates us, right, Loren? So we’re a company that’s five years old. As much as I thought in the past that space did not really matter, it makes a huge difference when you’re inviting clients or potential clients, as well as anybody who basically wants to get to know you. It’s basically your face going forward. And so I never used to think that it makes the decisions, but it really does.

I’ll tell you, even when I do the Zoom calls, typically, with anybody important, I’m going to do it from my office, making sure everybody can oversee an office. The reason is this, Loren: When you’re a startup, people don’t realize how small or how big you are. And at the end of the day, when people are going to plunk down cash to give you, they want to make sure that you’re not going out of business. That’s a huge factor into why customers will give you hundreds of thousands, if not millions. And so if you basically can show an office as your face that pretty much presents itself in the most special way, then they are not going to second-guess it. They’re thinking, “Hey, this company—I hadn’t really heard of them. They’re brand new. They say that they’re a startup. They’ve been out there for five years. How do I know they’re not going to go out of business?” You come into a space that’s 50,000 square feet, that’s got over 300 desks in it, it takes you 15 minutes to go from one side to the other. They’re not going to have that situation happen in their mind, and that’s the importance of having beautiful space.

Laura Zander:

So, I’m just gonna just be a total asshole. Being on the West Coast and living through the dotcom era—or at least the early dotcom stuff and seeing what happens there—I kind of feel like it’s the opposite. My perception is, if somebody’s spending a ton of money on their space, I don’t know, it just feels like it’s wasteful. At least that’s the perception. And we’ve just watched tech companies—and I know you guys are different—but from a tech company/West Coast standpoint, all of this money being spent on the damn ping pong tables and the cool architecture is not money that’s being spent on development. And it’s not money being spent on great employees. And it’s not money being spent on all of these other real things to really push the business forward. And I mentioned the West Coast stuff because my guess is that it’s completely different in Manhattan, and that appearances are extremely important.

Dana White:

So remember, when Karen said this, though, for her office in Seattle: She said she spent a lot of money on real estate because it’s what helps attract good people. She said, “We’re located where we are here in Seattle and where we are in our offices around the country, because it says something not only to our potential customers, but it also says something to the people who work for us, where they have a place where they can come and work. So she said, “Yeah, we spend money to be here, but it’s because of the message we’re sending to our clients and staff.”

Laura Zander:

Yeah, that makes sense. And that makes sense on the employees and wanting to have a beautiful space to go to and to be proud of, I guess. I get that. I get that. I think I bristle at the, “I want to do it just for appearances.” Just because we’ve watched so many companies go out of business because that’s what they were doing.

Loren Feldman:

It’s a legitimate question you’re asking Laura, and I’m eager to hear Diana talk some more about it. But it’s almost a cliché. Throughout history, lots of businesses have failed after spending too much money on their location. That is something that has happened a lot when people overreach. Did you think about that at all, Diana?

Diana Lee:

Yeah, so Laura, we are a tech and tech-enabled business. We have a development team, a data science team, account team, campaign team, and my business is really making sure that millennials—and the most talented millennials—join our organization. When people have not heard of your name, and you’re in New York City—and the reason that I’m in New York City with the highest amount of rent is because I need to attract the most highly-competent, talented employees out there. They’re going to look at the space, exactly what Dana said. They’re going to say, “Hey, this is a company I want to join. And so it’s not just about the space for me. It’s the fact that I have to pay for everybody’s lunches every single day. I have a company event on a monthly basis. I’ve thrown Botox parties for the employees. I’ve rented out movie theaters. Every single month I have a yoga bus that comes by.

Loren Feldman:

Were you doing this before the labor shortage, or is all this stuff the result of what we’re going through now?

Diana Lee:

I’ve been doing this for the last five years. I’ve had makeup parties. Every single month—and you could ask my employees—they have been spoiled blindly. On their fourth year, I gave them Rolex watches. I’ve done everything to keep talent, retain talent, including give company stocks. But for me, my business is very different, because it’s tech and tech-enabled. Once I lose them, I actually can go backwards on the development aspects of this. So it matters, not just to clients, potential clients, employees, but it is a part of my retention plan to make sure everybody is very engaged, satisfied, and wants—

Laura Zander:

That totally makes sense. And how’s it working? I mean, do you have any turnover?

Diana Lee:

Of course, we always have turnover, but it’s not with my A staff. I think I’ve gotten to the realization that you can’t keep everybody, but you must keep your A players. And so I’ll do everything to retain A players. In my mind, it’s not just a matter of making them feel special, but it’s also making them feel as if you’re gonna always support them.

Loren Feldman:

Dana, I want to check in with you, too. How’s the FUD feeling—the fear, uncertainty and doubt that you’ve talked to us about in the past?

Dana White:

The FUD is always there. Now, it’s become a familiar friend. But it’s subsided. It’s definitely not as bad as it was on the last episode. Our CNN article went live about nine days ago, last Tuesday.

Loren Feldman:

Tell us about that.

Dana White:

Yeah, it was amazing. It was a surprise, because they came at it from a different angle. In the initial article, they said my grandmother was the first woman in our family to not be a slave. And, of course, my family was all texting me, “Dana, what!!!? What does that mean?” And so we said, “No,” and they fixed it. But since that article’s come out, several opportunities have presented themselves—some extremely viable, others not so much. I’m happy to say that the United States Air Force, the United States Army, and the U.S. Navy have reached out to me. I’m a little bit further along with the United States Army.

Loren Feldman:

They’re trying to recruit you?

Dana White:

Right. They actually thought that I would be an excellent soldier, and I start basic in a month. No.

Loren Feldman:

Be all you can be?

Laura Zander:

It’s a guaranteed paycheck.

Dana White:

Right?

Loren Feldman:

What do they actually want?

Dana White:

They want Paralee Boyd on their bases. They said in their email to me that they believe that my business model, that Paralee Boyd, is uniquely situated to solve for the hair care issues with textured, active duty female soldiers and their families on their bases around the world. So we’ve had that preliminary conversation as to, “Okay, what does Paralee Boyd in Germany look like? What does Paralee Boyd in Fort Hood, Texas look like?” I’m scheduling my visit, to go see the three bases next month.

Loren Feldman:

Wow. Are there complications dealing with a government entity like that, that you have to figure out?

Dana White:

So I had some preliminary questions for our call, because—I’ll be honest with you—I, too, know the issues the United States military has had with African American women and their hair. I understand the fight African American women have had to have on behalf of their hair, because most people don’t understand—not only us, but our hair. And what I didn’t want was for the military to use Paralee Boyd as, “Well, now that we’ve got you—we’ve got a Paralee Boyd on base—you now have to do your hair like this.” I didn’t want that. And so now that that’s clear, that I won’t be forcing women who look like me to either go to braids or not, because you have to wear your hair like this, there are other complications as far as staffing, which we’ve talked about; marketing, which we’ve talked about; getting my products on base; pricing; contractual stuff, like rent; what all of these things are going to look like. So this definitely is a process, and there is nothing done. We’re still in the early phases, having conversations, and making sure that having Paralee Boyd on bases works for both the military and Paralee Boyd.

Loren Feldman:

Would these be franchised locations or company-owned?

Dana White:

They would prefer that they are company-owned.

Loren Feldman:

What would you prefer?

Dana White:

I don’t know. Because I have to get ready. The reason I don’t know is because I have to envision it. I have to envision what this looks like. That’s why staffing is important. I also have to make sure that I’ve developed as a leader, that I’m not the same person, or I don’t run the organization the way I did when I first started Paralee Boyd, which meant, “Oh, well, such and such called off from work, so now I have to go man the desk.” I can’t go man the desk in Germany. And then we can’t close down.

But what my network has told me—and I’ve spoken with people who have businesses in the exchange, which is where they would put me, the mall for the Army and Air Force—they could further confirm that you’re dealing with a different person, employee and customer, when you’re on a base. Nobody is going to jeopardize their standing on the base. Coming to work late, having a wife who has a husband who’s an officer, and she’s a cosmetologist, and she isn’t coming to work, that could jeopardize their standing at the base. And so they’re really not going to do that. She said, “You’re going to deal with a different type of workforce and a different type of customer.” And I’ve heard that a couple times from different people who have had businesses on military bases.

Laura Zander:

Does it fit your brand?

Dana White:

It does.

Laura Zander:

It does?

Dana White:

It does, and I was concerned that it would have to be this very structured… The good news is that the young lady that I spoke with—she was amazing—she has done her homework on Paralee Boyd. So it wasn’t, “Oh, I saw you in this article, and now I’m going to call you.” No, it was, “I’ve seen you in this article. This confirms what I’ve known so far. Now, let me reach out to you.” They’ve seen pictures of the salon. They know what my brand is, and they believe that it fits. So when we talked about the changes to my business in order for this to happen, there are not going to be many. When there are young ladies who are in basic training, I do want them to wear their hair a certain way for the health of the hair and ease of use for them. But it’s not, “Okay, you can’t have that color. Okay, you can’t have these products.” They’re very committed to making sure that the brand of Paralee Boyd stays, because they believe it fits in the exchange.

Laura Zander:

And customer-base-wise? I mean, this seems amazing, but customer-base-wise, are these the women who, once they leave the military, you want as your customers again?

Dana White:

Absolutely, yep.

Laura Zander:

Yeah, and potential franchise owners, right?

Dana White:

Potential franchisees in retirement. I’d already thought of that, because my vision for the franchise was already [that] I wanted veterans. I wanted people who hear the rules, who have a history of following the rules. Even Ray Kroc with McDonald’s, he went to the VFW and found his first franchisees, and so I’ve watched The Founder like seven times. And I said, “You know what? I want veterans.”

Laura Zander:

Yeah.

Dana White:

And so that’s what I’m looking for. Literally while we were on this podcast today, she’s sending me the demographic information. But if you all know me, that’s not enough. Saying that, “We have 80,000 African American women on our base. You’ll do great here.” No, I need to know: Of those 80,000 African American women, who is my captive audience? If we have 80,000 African American women who wear dreads, then my business isn’t going to thrive there.

So when I go down there, and I’m going to speak with her later on this afternoon, we’re going to have conversations on potentially doing a focus group—not only for potential customers, but also for people who are going to work there. She’s let me know that marketing will be done on television, radio, and military social media, and just the lengths that they’ll go to help me put this on base. Now, quietly, she said, “This is a security issue, and the military is very interested in having you on base because you being on base will help us solve a security issue.”

Loren Feldman:

What’s the issue?

Dana White:

You know, I’d rather not give the details on air. But when she explained it to me, I said, “Oh, yes.” It’s just there’s been some things that have happened on bases. And they noticed and said, “Would this have happened if there had been a Paralee Boyd on base?”

Laura Zander:

Oh, interesting. Got it. God, what a cool opportunity.

Diana Lee:

Dana, are you still self-funded?

Dana White:

I’m self-funded, yep. That’s my concern, and I’ve said that to them. My commitment is to franchising, and considering that they would prefer that these be company-owned—and they had a really good explanation why, and I completely understand—but my cost to build out these locations is going to be significantly cheaper than if I were to do it [as] just building off of a base. So we’re gonna go over those numbers.

Diana Lee:

Dana, is there a reason why you remain self-funded? Because the opportunity seems very big, and I would think that it’d be easier to do that opportunity if you actually took some investment money, especially if they’re willing to sign a contract on it.

Dana White:

I’m self-funded because the people with money do not understand the magnitude of the problem I’m solving for. They have no idea how much money Black women spend on hair. It is documented that Black women spend upwards of $5 billion a year on hair products. They spent almost double that on getting their hair done. But because this business model hasn’t evolved to a corporate, data-generating business model—the majority of hair stylists are one salon, two salons, salon owners, or booth renters, so they don’t know what the individual stylists in their salons are generating, as far as revenue. And quite frankly, a lot of the stylists I’ve spoken to don’t know what they generate, in regards to revenue. They might know what they do in a week, but they don’t have a profit and loss and go through, “Okay, now that I’ve generated this, how much is coming out for product? How much is coming out for whatever? All I know is I can pay my bills, I can pay my booth rent, and I have plenty of product.” And so the reason why I don’t have funding is because the people with the money have no clue how much money African American women spend on their hair, and there’s no data company that can collect the data, unless they’re gonna go to every individual stylist and collect that data. And they’re not going to tell you, because a lot of them are not paying taxes on that money. It’s cash.

Diana Lee:

So you have gone to investment bankers and said, “Hey, I want to actually give up parts of my company. Can you find a partner for me?”

Dana White:

I’ve had people come to me, and then it’s crickets. So they’ll go, “Oh, Dana, Dana, Dana, Dana, Dana, I get it.” I’ve had Black VCs come to me, “I get it. I grew up in a hair salon.” And then you hear nothing. And that’s okay. I’ve spoken with Loren about people who have come to me and said, “Hey, they’re interested.” And he’s always been a little hesitant about me giving up a percentage at Paralee Boyd. I literally had a VC, years ago in 2015, he even cautioned me. He said, “Because the value of Paralee Boyd today is going to be extremely different from the value of Paralee Boyd in 2025.” He told me that in 2015. He said, “If I were you—and my partners would kill me for saying this to you—take loans until you can sell it yourself, until you have your number.” He said, “The value of this is amazing. My wife is Black, and I’m letting you know, I don’t see her on Saturdays, and I don’t see her friends. And I know how much money she spends on her hair every week.”

Whereas the hair market that the men with money are used to, their wives are going to the salon maybe every six to eight weeks, maybe monthly. No, Black women go to a hair salon every week and spend upwards of $100 a week. And that’s just on themselves, not to mention their two or three daughters, or their nieces. I have customers I see sometimes twice a week. I have customers I see every other week. My average ticket cost is $65, and I see roughly 600 to 800 women a month. And I’m in a slow season. And I see it, but who am I?

Diana Lee:

Dana, obviously I see it as well, and I see a huge opportunity. I see how well you’re going to do in the future. I’m just letting you know from things that I’ve gone through and remaining self-funded and looking for partners and things, I had the same thing happen where people did come in: private equities, venture capitalists, as well as strategics. And I’m just asking you because I think that is completely different from actually going to and vetting out investment banking firms.

If you went to an investment banking firm—and let’s say you vetted three to five of them—they’re going to be able to tell you who they think the strategics are. They’re going to also tell you who would also be interested in that partnership. They’ll also do all of the number crunching on your side and give you a potential evaluation. But they don’t evaluate it from the past. They evaluate it from the future. So what I’m saying is, they’ll look at what your projected revenues will be from three to five years, and will be able to give you a low, a medium, and a high. And then they’ll say, “Hey, Dana, I really want your account, because I think I have the passion to sell it to somebody. These are the people we know. These are the people that we’ve actually done business with. These are the people that we have been in contact with. Will you pick us?”

And so you can even find investment banking firms to do it on contingency right now. But I feel like they’ll find you 100 potentials, and out of the 100, maybe you end up getting it down to three, and then you pick it out to one. But I’m just opening it up there, Dana, because this Army thing is a huge deal. And if you actually get them to sign it, then I would go to the investment banking firm saying, “I have all these opportunities. I don’t know if I want a partner yet, but I wanted to let you know that, with these opportunities, that partner is going to make a lot of money right now, so find me the partner.”

Dana White:

It’s bananas. The interest alone is outstanding. The Air Force and Army already have their timeline for me, and what they want to see. And to your point, “Dana, have you considered an investment banker?” I haven’t had time. I’ll be honest with you. I have not had time. I’m setting up this franchise business. We’re working on the operations manual. My franchise consultants are amazing, but there’s only so much they can do. I have my homework to do, in addition to managing my current location, which is easy, because I’ve got such a great staff. But I’m not an absentee owner. I do check in. I was there yesterday.

And so as far as investment banking, I just haven’t had time. And I’ll be honest with you—now that I’m talking, I’m thinking about it. I’m remembering the advice I got from an investment VC here in Detroit: “Make sure you know what you’re doing when you give away a percentage. This is too valuable.”

Diana Lee:

I get it, Dana, because in the past, I have feared investment bankers and all that. But I feel like your opportunity is very unique, in that you’ve got a big idea, and you’ve got to basically go out there, and you’ve got to scale this thing really fast before anybody else decides to actually do it. And so, from that perspective, if an investment banker’s able to find you a strategic that basically has already done a franchise model—especially in hair—and they know how to do it, and they have the contacts already, then I think it is a huge opportunity to be able to give up a percentage. And that way, you don’t have to worry so much, “I can’t do this, because of the scalability of what they’re asking for in the Army.” I wouldn’t even second-guess it. I’d be like, “Here’s the contract with the Army. Give me the money so I can scale this out. This is what I’m looking for. This is the dollar amount I’m looking for, in terms of valuation. I went to five different investment banking firms. They gave me all the different evaluations: high, middle, low. This is what the value is, based on my projections from three to five years.” And right now, money is the hottest. It is an all-time best time to find an investor.

Dana White:

That’s what Goldman Sachs told me. They said the capitalization on franchising is the highest they’ve seen in years.

Diana Lee:

Not even franchises. This is the most amount of investment banking right now that’s been happening in America, the most amount of SPACs that’s ever been here in the U.S. investing right now. There’s no hotter time in America to sell off shares. I believe that right now is the hottest time, and I don’t know if it’s going to ever get hotter than this. To take a few chips off the table might not be a bad idea at this stage.

Loren Feldman:

Dana, I’m curious, when you had this initial conversation with them, obviously, they’re aware that you’re just getting started. I’m guessing they have some finance opportunities that you might be able to take advantage of. Did they raise the possibility that they would help you fund this kind of build-out?

Dana White:

Not directly, because it was a really preliminary conversation. There’s nothing committed. It was more along the lines of construction and build-out and setting up the space to make sure that I could come in and just do it a lot cheaper than I could if I were to do something off base. So that’s it. Other people have told me, who have worked with the military before, they said, “With this opportunity and considering what you’re helping them solve for, you’d be surprised what calls they might be able to make on your behalf.” And so that’s the next thing that keeps me up at night, in conjunction with what Diana said was, “Hey, building it out and scaling it quickly enough to get the brand established.” And the only thing that’s stopping that is money.

I would be willing to speak with you, Diana—let’s exchange emails—and say, “Okay, who do you think I should be approaching?” I know, as far as information, I’m proud to call Goldman Sachs a part of my network. I’m proud to call Ernst & Young a part of my network. And maybe I can broach this topic with them. But I would love to speak to you just to get information on, “Okay, if I’m going to do this, once I get the contract from the Army and the Air Force—and when I tell you guys their timeline is aggressive, great googly moogly, it’s aggressive! They’re like, “Dana, we want this, this, this, and this.”

Loren Feldman:

My thanks to Diana Lee, Dana White, and Laura Zander. As always, thanks for sharing guys.