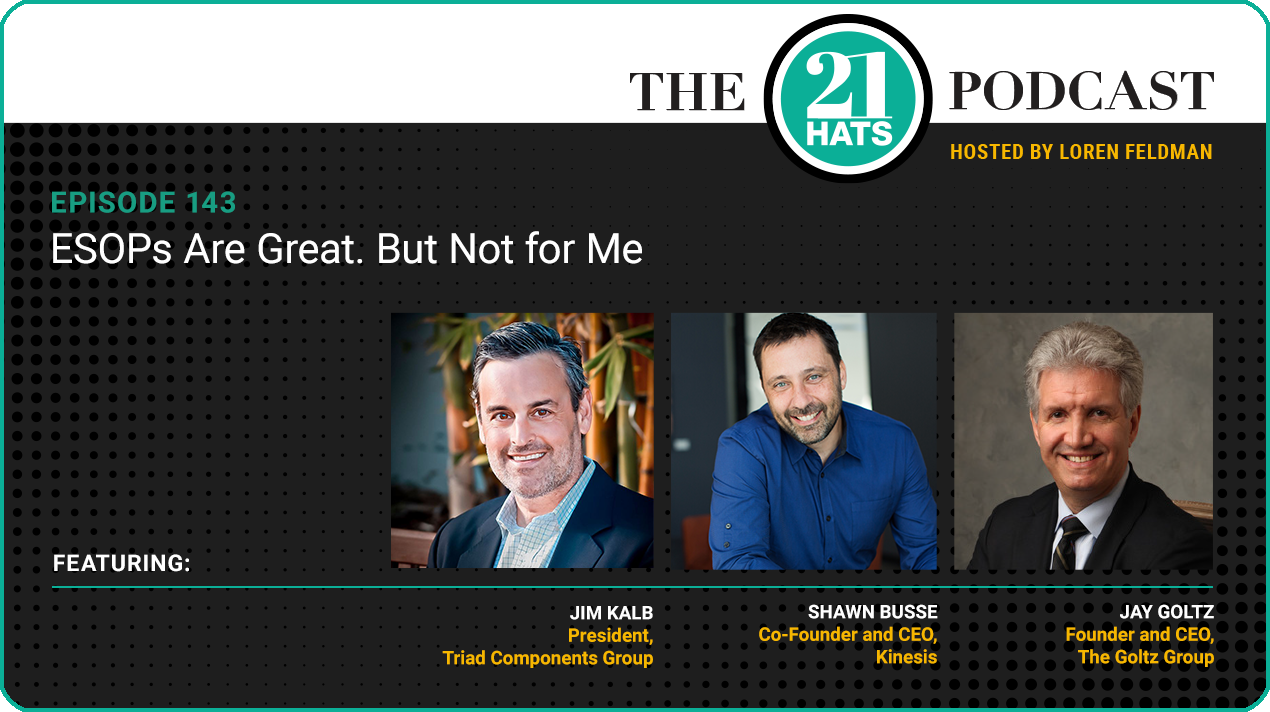

ESOPs Are Great. But Not for Me

Introduction:

Last week, Jay Goltz continued his exploration of employee ownership, flying to Portland to meet up with Shawn Busse and Jim Kalb, a friend of 21 Hats who has already sold a portion of his business to his employees. The three owners planned to attend a conference promoting employee stock ownership, but things went somewhat awry. Jay and Shawn left the conference early, Jim canceled his flight, and as has happened before in his brushes with ESOP professionals, Jay walked away feeling convinced—convinced, that is, that an ESOP probably isn’t right for him. Two days later, we taped this podcast episode, which quickly turned into one of the more raucous conversations you are likely to hear about a somewhat technical business topic—although we did manage to find some clarity in the end. In Jay’s words, we agreed to agree.

Along the way, we confronted quite a few relevant questions, such as, do ESOPs have to be so confusing? Are the professionals who pitch ESOPs trying to make them seem complicated? If Jay wants to sell 30 percent of his business to his employees but continue running it, how much control would he have to give up? Will an ESOP make life easier or harder for Jay’s two sons in the business? Instead of an ESOP, could Jay accomplish most of what he wants to accomplish by setting up a profit-sharing bonus plan through his 401(k)? Hanging over the conversation was a larger, more philosophical issue: What exactly do business owners owe their employees? And whatever those obligations are, do they extend beyond the sale of the business? Do they extend beyond the grave?

— Loren Feldman

Guests:

Jim Kalb is president of Triad Components Group.

Jay Goltz is CEO of The Goltz Group.

Shawn Busse is CEO of Kinesis.

Producer:

Jess Thoubboron is founder of Blank Word Productions.

Full Episode Transcript:

Loren Feldman:

Welcome, Jay, Shawn, and Jim. Great to have you all here. Jay, the last time we spoke about ESOPs, you told us that you were initially really excited about what an ESOP might mean for your businesses. But your joy quickly turned to oy, when you started talking to people in the ESOP industrial complex, and they kind of unsold you on it.

But you kept digging, and you wound up kind of rediscovering the joy, and even convincing yourself that you can actually make more money owning 70 percent of the business than you do owning 100 percent. And in fact, when we last spoke with Corey Rosen, a couple of months ago, you told us that in your mind, the question had shifted from, “Why would you do an ESOP?” to, “Why wouldn’t you do an ESOP?” So as we get started here—you just flew to Portland to hang out with Shawn at an ESOP conference—where’s your head at now?

Jay Goltz:

Well, I discovered why you wouldn’t want to do an ESOP—just for me. I think ESOPs are great things for many companies. But I have to tell you: I’ve now seen it through four or five presentations from, as you call it, the industrial complex, which is a good phrase for it. Not people who have done them, but the people who are administering them, the people that are helping with them, and employees.

I don’t think I’ve seen one business owner, other than Jim, who’s on this with us today, actually talk about it. And I had to figure out why this doesn’t work for me—just for me. So first of all, you have to have a team in place. Check.

Loren Feldman:

Wait, before you go through the—you’re about to list why it makes sense. Let’s come back to that. First, I’m just curious, this was a conference designed to encourage people to do ESOPs. Tell me about the conference.

Jay Goltz:

It’s just like everything else I’ve seen, every one I’ve gone to. I start with joy, and then it quickly goes to oy, listening to the people: the complications, the questions. Here’s some oy from Monday: They did a study of people who have done ESOPs and they found that 60 percent of them were very happy, 30 percent were somewhat happy, and 10 percent weren’t happy. And I said, “Why are the 30 percent somewhat happy?” And the answer turned into the two people at the front who were with the company: “Well, I don’t think our clients are like that, are they?”

Like, no one will tell you the truth. Someone who does an ESOP is not happy. I’d like to just understand why this could go wrong. And I have yet to get anybody to give me a straight answer on that. So it started me back to where I started with this. It took me a while to figure out why, for me personally, this doesn’t make any sense.

Loren Feldman:

All right, let me stop you there for a second. Shawn, did you have the same reaction to the conference in Portland?

Shawn Busse:

Yeah, I mean, I had a struggle with it, because I think it was structured in a way that doesn’t necessarily serve the best interests of people who are curious about becoming an ESOP.

Loren Feldman:

That’s the whole point of this conference, right?

Shawn Busse:

Well, I think it should be, but—

Jay Goltz:

Wait, but the title was, “Is an ESOP right for you?” That was the title!

Shawn Busse:

Right, and so I think Jay and I went there with a goal of becoming educated and learning. And we quickly found out that it was far too much in the realm of being a sales seminar than actually an educational seminar. And the fact that there weren’t other ESOPs in the room, like folks who had become ESOPs who we could connect to and say, “Hey, what are the pros and cons? What should we believe? What shouldn’t we believe?”

Instead, it was a room full of people who wanted to become ESOPs and who needed information, like us, and then a lot of vendors. And the vendors had paid, I think, a lot of money to be there. So there’s a flaw in that model, right? Because the incentive is to fill a room full of potential prospects and to sell to them.

Loren Feldman:

We happen to have an ESOP in this room. Jim, I’m curious, it’s been a while now since you made the decision you did, and I know you’re happy with it. Did you kind of have to fight through this as well? Did you have a tough time figuring out whether it made sense for your business?

Jim Kalb:

No, actually, so I went a different tack. These guys went to a seminar from, I believe it’s called, NCEO, which is—

Loren Feldman:

The National Center for Employee Ownership.

Jim Kalb:

Okay, there we go. And again, I used to be a member of this. So I went the route of, I went to the University of California in San Diego, because I’m here in San Diego. And so they were very, very positive about all this. It was actually a seminar I heard about 20 years ago from the same group. So I went through a different route, and they don’t have any vendors. They don’t have anybody. There’s just a bunch of information on the campus of UCSD. And so I’ve never been to an NCEO event.

Jay Goltz:

I want to make something clear. The problem in my mind is not that there are vendors. You just highlighted it. You went to a university, where they teach. They’re professional teachers. They know how to teach. We go to these things. I’m not saying any of them are dishonest. I’m not saying anybody’s pulling the wool—they don’t know how to teach.

It’s not that they’re bad at selling and explaining; they’re horrendous at it. They go to these complicated charts with circles and squares, and, “Well, you’ve gotta get warrants.” And I’m thinking to myself, “How many people in this room know what a warrant is?” And they go on and on and on and on and on. And you can just see people’s heads spinning, including mine. They could start with, “Let’s tell you why people do ESOPs, why they work out great—and why sometimes it’s not appropriate.” Just like if you went to school. They’re not teachers. They’re investment bankers, lawyers, and accountants putting on seminars. They talk shop to each other, and they lose the audience. And they don’t even realize they’ve lost the audience.

Shawn Busse:

Yeah, that’s true. I finally got some clarity. I spoke to a guy in the room, who I actually think was probably my best connection of the day. And he’s a one-man shop, and he basically does exclusively ESOP work—everything from feasibility studies, and so forth. And he said to me, “These are big companies in this room, and they’re looking to sell to big companies. And their mission is to make it complex and hard. And that way, they can generate more fees.” And I was like, “Yeah, that kind of feels like what’s going on here.”

Loren Feldman:

All right, but so here’s the question: You don’t want to reject doing this, Jay, just because they’re bad at marketing.

Jay Goltz:

Correct. Correct. And you warned me about that, because you’re good at calming me down. And you were right. And I stayed calm for a few minutes.

I finally lost it when I asked the question about only 60 percent were really happy, and the guy at the back who was running it was like, “Well, 30 percent were somewhat happy.” And I had to go, “Yeah, not real interested in somewhat happy. That’s not my goal—to be somewhat happy.” [Laughter]

Loren Feldman:

Good thing I calmed you down.

Jay Goltz:

Yeah, right.

Loren Feldman:

Tell us—just to make clear that it’s not just the bad marketing that’s turning you off—why are you cooling on this now? What have you learned that doesn’t make sense to you anymore? Because before you thought you were going to make more money, and your business was going to be stronger. It was going to keep your employees.

Jay Goltz:

Okay. It starts with this. Why was I looking at this? I’m concerned about my 401(k) balances for my employees. Half of them don’t have anything in there. That was the first thing. And two, I wanted to do something that could be a little more glue to keep people together, working together.

I realized that the problem is: I’ve got four out of the five criteria for, “Is this a good thing?” I’ve got the team in place. I care about my employees. I don’t need to get the top dollar for the business. And I don’t need all my cash out. So four out of five, I’m right there. The fifth one is where it falls apart: I’m not going anywhere. I plan on being around. My kids are going to take over the business, which means the money that I’m getting for quote-unquote selling the business is my own money. All I’m doing is taking my own money out. It’s not like I left, and I’m fishing every day. So the whole idea—

Loren Feldman:

Wait, let’s stop right there. Because this gets complicated, and someone’s gonna have to explain this to me like I’m a five-year-old.

Jim Kalb:

Jay, you’re wrong, though. Jay, you’re wrong.

Loren Feldman:

Go, Jim. Tell us. Tell us why, Jim.

Jim Kalb:

It’s your own money, tax free.

Jay Goltz:

So is the money that I get from earning the money. I’m giving away—think about it. First of all, the interest on that is not tax-free. That’s what I learned. It ‘s really not true.

Loren Feldman:

Wait, we’re covering too much ground too quickly here, I think. Let me set this up. The traditional way for doing an ESOP—and maybe this is the way Jim did it, you’ll tell me—is most of the time I think the employees get shares in the company by borrowing money that is paid to the owner. You’re interested in doing it in a slightly different way, which other people do, but it’s less common, I think. You don’t need the money out of it, so you’re going to lend the money to the employees. Correct?

Jay Goltz:

Yeah, but here’s the fallacy. I don’t need to sell anything. I gave away a revenue stream for no reason. That’s the point.

Loren Feldman:

But you’re not giving it away. You’re selling it.

Jay Goltz:

But I’m giving away the revenue stream from it. So it’s the same thing. It’s my own money. I’m giving away a thirty percent revenue stream.

Loren Feldman:

You’re giving them 30 percent of the company, but they’re paying you for that.

Jay Goltz:

They’re paying me with my own money! I haven’t left. I’m going to work every single day.

Loren Feldman:

They’re going to pay you with profits that the company makes over time.

Jay Goltz:

That’s called my profits.

Shawn Busse:

So what Jay’s saying is if he just kept ownership, he would get that money anyway.

Jay Goltz:

Right.

Jim Kalb:

So think about all the other things that Jay wants to do. He wants to engage his employees. He wants to use it as a recruiting tool. He wants to show that he’s an employee-owned company to help gather new customers and as a marketing tool. And yes, eventually, you’re gonna have to sell some stock, or you’re going to give it away to your kids. So one or the other, you’re not going to have it when you die.

Jay Goltz:

Okay, everything you said is true. The problem is, I get to a non-negotiable, which is: I do not want to hang my kids with responsibility to a bunch of stockholders, trustees. I don’t know what’s going to happen. I have four different businesses. And the one guy who I talked to, he goes, “You’re gonna have a real hard time getting a good appraisal of a lot of that.”

I’ve got a weird business with four different businesses. Is it possible, in 20 years, one of them is going to peter out? I mean, you’re talking to a kid who watched his father’s dime store slowly but surely become irrelevant. I don’t know what’s coming down the road. I don’t want to have to hang my kids with some responsibilities to a bunch of people, so those upsides aren’t worth it, is the point.

Loren Feldman:

Jim, does that apply to you? I think you have multiple businesses.

Jim Kalb:

I have three businesses. But here’s the thing: then you’re gonna just saddle them with having to sell the business eventually.

Jay Goltz:

Which I don’t want to do.

Jim Kalb:

And then by the way, that control issue, that is a complete fallacy. So as long as you control the board, you can control the ESOP.

Jay Goltz:

Okay, here’s your fallacy with that, which they made very clear in this room: You can get sued.

Jim Kalb:

You can get sued for anything, for anything, by anybody, anytime, that whole line. So, yes, you can get sued, but the practical application of that is you will not get sued. Because again, if you don’t do anything wrong—

Jay Goltz:

No, they can say, “Wait, what do you mean you’re closing this one division? You shouldn’t be doing that.” And here’s the problem, which is what’s so infuriating—

Jim Kalb:

Who’s they? The trustees?

Jay Goltz:

The stockholders who you’ve given stock to.

Jim Kalb:

The stockholders have no say in your business whatsoever. The only person who has a say is the trustee.

Jay Goltz:

Okay, I got it. Are you telling me though, that one day, my kids wake up and go, “You know what? Somebody offered us X zillions of dollars for the building,” which they don’t own, “and we’re going to sell the building and close the business.” Are you telling me none of those people could go and sue us for some reason?

Loren Feldman:

When you say “they don’t own,” you’re saying the employees don’t own the building; your kids do. So you’re imagining a situation where you’re gone, and the kids get an offer for the real estate, which is suddenly much more valuable.

Jay Goltz:

Which happens every day.

Loren Feldman:

And they want to sell, and close the business. You’re worried about the ramifications of that. Jim, what do you think of that?

Jim Kalb:

Well, Jay, you’ve already talked in previous podcast episodes that you have, what, $4 million of inventory, or 10 million?

Jay Goltz:

Right. That’s part of the problem. It’d be cheaper for me to just close.

Jim Kalb:

When you sell the business, you’re gonna liquidate, and then your company will have some money, some cash, at that particular point in time. And then the employees will take whatever cash at that point, just like selling it to somebody else. By the way, if your kids decide to sell the business for $5, $10, $20 million somewhere down the road, the employees will just share in the proceeds from that sale.

Jay Goltz:

Here’s the problem: I’ve been through four webinars with this. And every time I try to get any of this out of these quote-unquote professionals… Monday, when I asked what are the reasons why that 10 percent are really unhappy, these guys looked at each other in front of 50 people and go, “Well, I don’t think that’s true with our customers, do you?” “No, I don’t think so.”

The fact that I have to ask you, a guy who did an ESOP for his own business—and it seems like it’s a great thing for you—the fact that I can’t go to a webinar and talk to a quote-unquote professional to find out what are the downside potential things, and no one will give me a peep, is extremely disturbing and infuriating—for paying for airfare, for paying for membership, for going to webinars. They just won’t tell you the truth. This clearly is not right for everyone.

Loren Feldman:

But again, you don’t want to walk away from this because they’re bad at marketing it.

Jay Goltz:

No, I agree. I figured it out. This isn’t right for me because I can accomplish the same—most of it, I fully agree with Jim, not as much—I can 80 percent cover this by simply doing a bonus plan through a 401(k) plan. I can take care of my 401(k) concerns with my employees. I can give them an incentive by doing a profit-sharing thing. And I can accomplish that goal. And I can pay less taxes because obviously, when I give them money in that 401(k), it’s deductible.

I can get 80 percent there without going through what is continually said in the books and in webinars: “This is a lot of hard work.” They keep pounding that away. “This is a lot of hard work.” Not real appealing to me. I’m thinking, this is like getting a cow because you want a glass of milk. No, I think I’ll just go to the grocery store and buy a quart of milk. I don’t need to own the cow. I don’t need all of the ramifications.

Shawn Busse:

Jimmy, what was your experience, in terms of the level of difficulty? And I think it’s important to recognize you’re a DIY guy.

Jim Kalb:

Okay, so here’s the issue here: It wasn’t hard at all. I engaged the UCSD people. They were my consultants on this. The cost on them, they had four modules, different steps along the way, about $5,000 per module. So I ended up with two out of the four modules. Otherwise, I didn’t need it. I had an attorney who walked me through all of the other types of—in fact, I had this for you for Tuesday, Jay. I have this whole checklist of things.

Loren Feldman:

We should say, Jim, you were gonna go to Portland and join Shawn and Jay at this conference. But when Jay aborted it, the plans fell through.

Jay Goltz:

Keep in mind, I didn’t abort it. I called him to see whether he was really hot. I would have waited around if he was coming up. But he had his own things going on. And he was thrilled to get off the hook. So I didn’t just abort. We all aborted it.

Jim Kalb:

So the point is, it wasn’t hard at all. The hardest part was just educating my staff on what it was. And so I have these one-on-one meetings with them. Remember, my staff is a lot smaller than yours. I only have 21 people. So it’s much easier for me to meet with my staff, go through their statements, show them how much stock they have, show them how much it’s worth, show them what their vesting is. And it’s really, really simple for me to be able to do that.

I want them to be financially literate. And not necessarily open-book management. We do open-book management, but I want them financially literate—what makes us money, and what adds value to their stock.

Jay Goltz:

What do the lower-paid employees make?

Jim Kalb:

My lowest-paid employee makes about $19 an hour as a warehouse guy.

Jay Goltz:

Okay. All right.

Shawn Busse:

That’s pretty reasonable, in terms of a parallel. My understanding is that 20 is about the kind of minimum threshold number of employees, and that if you have a company that starts to shrink, you can run into… I mean, it was referred to as the nuclear situation, where the percentage of stock owned by a number of people gets too low—or too high, I guess. Can you address that at all, if you know what I’m talking about?

Jim Kalb:

Yeah, I do. And so, by the way, Shawn, I’m at 21 now, but when I started this, I was at about 14.

Shawn Busse:

Oh, cool. Okay. All right.

Jim Kalb:

So what I did was, in order to stop that, a couple of things happen. I use a formulation, based on how much salary they make. So when I’m attributing stock, if someone makes $400,000 with my company, I’m only going to attribute the first $150,000—or three times what the lowest person makes in the company. So if I have someone who only makes $40,000 a year, then the maximum amount their salary can be is $120,000. It’s three times the lowest person.

But that’s what their allocation is, so no one’s going to ever get really super top-heavy in this situation. But that’s one of the decisions you can make going on. Again, there’s a little template you can use to just take you through all these decisions: what the vesting schedule looks like. If someone were to leave, what happens then?

Jay Goltz:

I want to be clear, I’m sure for you, you’ve figured it out, and it’s going to work out great. It’s just in my case, the fact that I’m not planning on selling the company down the road, it just doesn’t make any sense. That’s all.

Jim Kalb:

I’m not selling the company. I’m selling the company to them, to the employees. I’m not selling it to anybody else.

Jay Goltz:

That’s fine. But you are going to sell the company, then, which I think is a great thing. But you are planning on completely being out of it.

Shawn Busse:

Has that changed for you, Jay? Because I feel like you’ve kind of ebbed and flowed on whether you want your children to run the business.

Jay Goltz:

No, absolutely not. My kids are probably going to be here. And no, I do not see down the road that we’re going to wake up one day and say, “Did you sell the business?” And I think if I was, I fully support the ESOP philosophy, the model. I think it makes perfect sense.

In my case, though, I talked to a guy who sold his ESOP, and he built an incredible company. He went from three employees to $250 million, and he did an ESOP. And now he’s in Florida. And he tells me, “Well, listen, you don’t want to die at your desk.” And I go, “Wait, wait, wait. Maybe I do. That’s an assumption you’re making.” He told me he’s got two boats in Florida. Like, I have no interest in having two boats in Florida.

So for me, I plan on working for another 20 years, or something. I’m in a very different place than someone who says, “I want to be out of here in five years.” And then I also, like I said, don’t want to saddle my kids with all of the potential problems. For instance, what if business goes down, the stock goes down, and all of a sudden, people are pissed about it. I don’t wanna have to worry about any of that.

Loren Feldman:

Jim, is that a concern?

Jim Kalb:

It could be. But again, if they understand what the dynamics are. At my company, they all understand this. We’re all in this boat together. So if it goes down, it goes down, and with the understanding that: If we work hard, it won’t go down. But back to Jay’s point, though: If you’re bonusing them out each year, and all of a sudden your profits go down, you don’t bonus them in that year…

Jay Goltz:

Right. I do open-book management.

Jim Kalb:

Don’t you think you’re going to have some angry employees?

Jay Goltz:

No, we do more open-book management. We explain to them where we’re at. No, I think they’ll understand that, “Listen, we had a bad year. Here it is.” But here’s the other issue: I’ve got lots of people who, in the next 10 years, will be retiring. I’m confident, doing the math, they’ll have more money doing it this way. The ESOP pays off in the long-term.

In 10 years, I’m gonna do this in a way that they’ll have more money in 10 years just getting their bonuses on their 401(k) than they would have gotten doing an ESOP, because a lot of the money in the beginning, apparently—and this is what no one will give me the exact number—some of that money you’re putting toward the trust is paying me back. Well, they’re not paying me back now. So it’s gonna go right to them, right in their 401(k) plan. It’s just cleaner. And I like to call it an elegant solution that didn’t occur to me until now.

Loren Feldman:

Jim, one of the points I’d like to go back to that Jay has made is the issue of whether he’s giving the company to employees—or a percentage of the company to employees—or whether he’s selling it to them. Jay’s expressed the concern that if he didn’t do that, he would just get that profit stream that’s now going to go to the employees. So essentially, he’s giving it away. Is he right about that? Is that the way you look at it?

Jim Kalb:

It is. So Jay has now changed, as far as I’m concerned, the dynamics, or changed the ideas going in. And the idea going in was: My kids don’t want it. I need to find a way to dispose of it. Now it’s: My kids want it. And there’s no need to dispose of it any longer.

Jay Goltz:

Okay, that has absolutely never been the case. I never said my kids don’t want it. Absolutely, not. Maybe you heard that. But that’s not been the case.

Loren Feldman:

You expressed more doubt about where things might end up. I don’t think you ever were convinced one way or the other, but you wanted options.

Jay Goltz:

Right, and I still have options. That’s the beauty of this. Using my plan now, if that turns into a situation, there are still options. They can go and sell the business. They can do an ESOP. They can do whatever they want after I’m gone, or while I’m here. But I am expecting that they’re going to be here. The point is: options. I like the options. I have no reason to lock myself into something that I’m going to wake up one day and say, “Yikes, what did I get myself into?”

Jim Kalb:

And again, I’m not like that. I don’t see it that way at all. I look at it as kind of a godsend. So what I’ve built can now go on forever.

Jay Goltz:

You want to retire. That’s the difference between you and me. You want to retire.

Jim Kalb:

I want to semi-retire. I’ve got a succession plan. I know who the young kids are who are going to take over my business. You’re gonna retire eventually and your kids are gonna take over. So now again, you won’t call it retirement.

Loren Feldman:

He wants to die at the desk, Jim.

Jay Goltz:

No, it might be called dying. And how long is your plan? In five years you want to retire?

Jim Kalb:

It started as eight years. And so, now I’m three years into it. And then my wife is going to retire in about six years, and so I’ll retire with her.

Jay Goltz:

Okay, I have no plan on doing that. That’s the difference.

Jim Kalb:

But again, though, I’m not going to retire completely. I’ll still be on the board—because they’ll still owe me money. So I can’t necessarily just walk away. Yeah, the bank will give me the money at the end. But the company still has to be around to pay the bank. So I’m still on the hook for that note that the bank is lending the company.

Jay Goltz:

You just kind of summed it all up. You’re still on the hook. If I was to sell, I do not want to be on any hook. I want to just be done. Either I want to be running it, or not running it. I don’t want to not be running it and be on the hook. Those two things together are not an appealing combination. So in my case—

Shawn Busse:

I think this is super simple: I just don’t think Jay wants other people telling him what to do.

Jay Goltz:

Absolutely, absolutely. No, there’s no question.

Loren Feldman:

But the question is whether you’d really be in that situation or not. And I think you’re very concerned about the role that the employees would play in managing the company after you do an ESOP. And Jim’s telling you that they don’t have any role.

Jay Goltz:

No, you’re really missing it. This is what’s changed: one thing. It now occurs to me, I can solve my quote-unquote problem by simply doing an incentive bonus plan through a 401(k). I get the deduction. They get money. Done. Solved the problem.

The rest of this, there are so many moving parts, and all when you go to the seminars, all you hear from everyone is, “This is complicated, and this is a lot of hard work.” And every time I go to these things, I think to myself, “Why would I want to do this to myself when I can simply do my new solution of simply doing a bonus plan through the 401(k)?” Problem solved.

Jim Kalb:

Why is the ESOP so hard, in your opinion?

Jay Goltz:

Well, after sitting through four webinars, they’ve convinced me that it’s so hard because they keep telling me this is really hard! Every single one of them. The book says it three times. “This is really hard work.” That’s what they keep pounding away on.

Jim Kalb:

How many of those people you’re talking to actually have an ESOP? I do, and I’m telling you: It’s not that hard.

Shawn Busse:

Yeah, and I also think one of the things that was a trigger for Jay in that event was, you had lawyers in the room talking about fiduciary liability and risk and lawsuits, and blah, blah, blah, blah, blah, blah. And this is why I didn’t like the event. It’s because, essentially, they’re trying to create fear, uncertainty, and doubt so that, in their minds, you hire them. But for people like Jay, that kind of message is terrible.

Jay Goltz:

No, you missed the other bigger trigger. The guy they had speak who was representing ESOPs said he did an ESOP. And he went through the whole story of how he did the ESOP. And at the end of the day, he was an employee. He didn’t own the company. He started the speech by saying, “I want to just contradict what someone just said—’Well, the employees are getting this, and they’re not paying anything for it.’ What do you have in a company without employees? Nothing.” He’s basically saying, the employees have earned the right to take over this company, because they’re employees.

And like, I said at the end, I said, “So you’ve never owned anything?” “No.” I want to hear from somebody who borrowed against their house, who spent 40 years with the stress and the risk—not from this guy. And I’ve yet to see one person in any of these webinars stand there and say, “I used to own the company.”

Now Jim, you’re that guy, which is why I was listening to it. You were convincing, which is why I was continuing this. And I got this all from you. But I just realized, for me personally, I solved my problem with the 401(k) plan. And it’s just not worth the exposure to the potential problems.

Jim Kalb:

Again, you’re looking at the problem, though, just being: I want to give money to the employees for doing a good job. And you’re right.

Jay Goltz:

Yes.

Jim Kalb:

If that’s your situation, you feel good about yourself that they can retire a little bit more comfortably.

Jay Goltz:

Yes, yes.

Jim Kalb:

Then that’s fine. If that was your problem, you’re absolutely 100 percent right. This will fix your problem.

Jay Goltz:

I knew we’d agree at the end of this. We can agree to agree. No, I mean it. That’s the case. That is the case.

Shawn Busse:

I think Jimmy’s perspective is really important, because—

Jay Goltz:

Absolutely.

Shawn Busse:

I think about my business. I don’t have any children, and I know my brother—well, my brother’s only five years younger than me, so he’s not going to want it. And I also think about, “How do I do right by the people who helped me build this thing?” And the ESOP industrial complex, they’re motivated to create a sense of confusion and necessity.

So one example: There was a group in the room that that pissed off Jay so much, that was saying, “Well, all of our customers are happy.” Their feasibility study for doing an analysis—do you remember what it was, Jay? Was it like 35 grand? Was that their price?

Jay Goltz:

Whatever, he admitted that it doesn’t work for some, but he never told us why! He admitted that, that sometimes the feasibility study comes back that it’s not worth it.

Shawn Busse:

And that’s fine. But anyway, my point being, that their cost structure for doing that thing, just to assess, was tens of thousands of dollars, in that range. The solo guy in the room was like, “That’s ridiculous.” And they’re that way, because they’re a big organization. I mean, JP Morgan was in the room, just to give you an idea of the organizations that are there. And he’s like, “My feasibility study is, like, $7k.” And I think Jim was saying, what, $5k through the college system?

And so, what I’m starting to see here is that there’s a way to get this done. But unfortunately, the national organization is structured towards the high end of the cost structure and towards the larger corporations.

Jay Goltz:

Wait, wait, let’s talk about why: Because those are the people who paid the money to sponsor this.

Shawn Busse:

Right. Yeah, totally.

Jay Goltz:

So unfortunately, it’s designed for the bigger companies to be doing these speeches. And like, I think you’re giving them too much credit. I don’t think they’re trying to make this confusing. I think they just don’t know how to explain things.

Shawn Busse:

It might be both.

Jay Goltz:

For sure.

Loren Feldman:

Shawn, where does this leave you? Are you still thinking of this as an option for your business?

Shawn Busse:

I think it’s a great option. My business, I’ve got to prove the model further. We’re where Jimmy was when he started his journey, size-wise. Our model is probably more volatile than his. Before the pandemic, I was like, “Yeah, we’re on this train.” I’ve proven consistent marketing, consistent delivery of customers, consistent growth, good profitability. And I was like, “Full steam ahead.” And then the pandemic really undercut us. And so I’ve got to regain that confidence and growth trajectory so that, yeah, I get to 20 people, and I can make that happen. But I think it’s a great way to go.

One thing I want to ask Jimmy, though—it’s never been addressed in these conversations—I’ll just use an example. There was a company here in town that provided winery supplies, and they converted to an ESOP. And it was like such a cool thing, such a community good. The employees all got this tremendous benefit. Private equity comes along and says, “Hey, we’ll buy you, ESOP.” And then the employees look at that offer, and it sounds like they voted yes. And so then it becomes owned by private equity. And they eviscerate the company, move it out of the community, do what private equity does. I’m curious, Jimmy, if you’ve thought about that.

Jim Kalb:

The answer is yes. So this was actually brought up at a seminar I was at. And so the guy was talking about how they had done an ESOP, and private equity came to them. But remember, it goes to the board. The board is the one that entertains any type of offers for whether the company’s for sale or not. And who’s the board made up of? The board is made up of directors. So here’s the symbiotic relationship, so back to Jay’s thought about control. You never lose control as a selling owner. Unlike if I were to sell to a PE company, I would lose control.

Jay Goltz:

For sure, for sure. No argument there.

Shawn Busse:

Talk about that trustee piece, because I think that was a trigger for Jay.

Jim Kalb:

We have three directors on the board, including myself, one of our employees who doesn’t necessarily have to be an employee, and an outside director, who’s a friend of mine. He’s a long-term friend of mine who’s a retired CFO for a public company. So we sit on the board, and then the board basically hires a trustee.

And in this particular case, the board hired me to be the trustee because I’m not selling any stock right now. Not for another couple more years. So at that point, we’ll have to hire an outside trustee, but the board hires that trustee. But the way we’ve done the election on the board is, every board member has a three-year term, only one of which comes up every year. So there are still two out of three people on the board at any given point in time. So even if the trustee comes in and says, “I’m going to hire my own board member,” the two other board members could easily just fire the trustee.

Shawn Busse:

I see. Okay, so that’s how you maintain control.

Jay Goltz:

Shawn, I just want to say two things to you. One is, everything triggered me. And B, you hit it on the head. You know what, I’ve put everything I have into this company for 45 years. I’m the one that took all the risk. I just don’t need to have this whole thing. I just have no interest. And if I had to do it to solve my problem, maybe I would. But I figured out how to do it without any of this.

So like I said, I’m sure this is going to work out great for you, Jim. I’m sure that there are lots of companies that should be doing this. Given my exact circumstances, the cure is worse than the disease. There is no disease. I got it figured out: 401(k) incentive plan.

Jim Kalb:

I agree with you. Jay, you’re absolutely right. For your situation, you’ve now convinced me that, in your situation, that’s the right thing.

Jay Goltz:

Yeah, I knew we would get to this.

Jim Kalb:

For Shawn and I, though, it’s a different situation. We’re in different situations.

Loren Feldman:

Jay, since we seem to have agreed to agree, tell us a little bit more about your Plan B.

Jay Goltz:

Here’s what changed: From day one, you called me a year ago, and you said, “Have you looked into the ESOP thing?” “Not really.” And you explained to me that you can sell part of it to your employees, and then there’s no federal income tax. And I said, “Oh my God, think about it, you’re gonna use the tax savings from the 30 percent to basically buy this portion. It’s like free money from the government.” What didn’t occur to me until I finally figured it out is, by giving money as an incentive plan, I’m saving the taxes that way.

Loren Feldman:

Wait, spell that out. What’s the plan?

Jay Goltz:

Yeah, I go ahead and do an incentive plan through a 401(k) plan. And I mimic the ESOP theory. I take the employee salary divided by how much they’ve got, compared to the rest of payroll. Or I just do a straight percentage, whatever. And I go ahead and do an incentive plan and put everybody into it, because this is the part that no one ever said to me.

This is how they should do these seminars. They should start it out by saying, “Do you care about your employees?” “Yes.” “Okay, good. Has anybody paid any attention to their 401(k) balances?” No one ever told me that when you do a 401(k) plan, in 20 years, half your employees aren’t going to be in it. It never occurred to me that was going to be an issue. And that would get people paying more attention to this whole thing.

Loren Feldman:

So how does this plan actually work? You’re bonusing them based on the performance of the company?

Jay Goltz:

Right, and you do that for 10, 20, 30 years, and they’re going to have some money.

Loren Feldman:

You set up a percentage of profit that every year goes into the 401(k)?

Jay Goltz:

Yeah, and if I want to make it more than one year, I can go, “You know what? Instead of doing 15 percent, I’m gonna do 20.” Yeah, it’s easy, totally in control, and everybody’s happy.

Loren Feldman:

You’re giving that money away.

Jay Goltz:

Absolutely.

Shawn Busse:

Okay, let me play devil’s advocate for this, Jay.

Jay Goltz:

Sure.

Shawn Busse:

You have a health event in five years. Your kids take over the business. And they look at this plan you’ve built and they’re like, “You know, Dad was real generous, but I want the money now.” And they leave the employees hung out to dry now. Now I’m not saying your kids are going to do this.

Jay Goltz:

No, no. What does that mean “hung out to dry?” What does that mean? They stop doing it?

Shawn Busse:

They stop doing it. They cancel the plan. They take the profits themselves. They just have a really different value. You’ve talked about this a little bit.

Jay Goltz:

I got it.

Shawn Busse:

You’ve talked about how your children have a slightly different take on profitability than you do.

Jay Goltz:

I got it. Okay, I have an answer to that.

Shawn Busse:

And so then, really, your goal of caring for your employees is just basically wiped out in that one moment. Whereas in an ESOP, it actually is a lot harder for that to happen.

Jay Goltz:

Okay, I have an answer. Here it is: A, I don’t think my kids would do that, and B, if they did, I’m going to go set up a system to screw my kids over long-term? Oh, they’ll have to be controlled? Priorities. No, I’m not going to set up a system because I don’t trust my kids are going to do the right thing. So that, “Well, that way, they can’t screw over my employees.” I’m not doing it.

Shawn Busse:

I mean, you never know.

Jay Goltz:

Again. I’m not saying they wouldn’t—I don’t think they would do it. I’m confident, but you’re right. They could do that.

Shawn Busse:

But things happen, right? You know, divorce happens. That’s a great example right.

Jay Goltz:

Okay. It comes down to: Who do you trust more, your kids or your employees?

Loren Feldman:

Well, that’s an interesting question. You trust your employees greatly.

Jay Goltz:

I do. And I trust my kids, too. But like, at the end of the day, do I want to set up a system where my kids end up with this harness around their neck, that they ended up with this business, and now they’ve got stockholders? Why would I possibly want—

Shawn Busse:

Just so you know, Jay, you’re giving them a different version of a harness? Right?

Jim Kalb:

Yeah, exactly. Exactly.

Shawn Busse:

You’re giving them the responsibility of the company, which, I’ve heard tension there. On the last podcast, like, I’ve heard you say, “I’m not sure they want this.” It is a big responsibility you’re handing over to them.

Jay Goltz:

Yeah, yeah. I encourage everyone to do this—I typed up an if-I-die sheet. I change it every year. And I explain to my wife and to my children—I’ve been in lots of business groups, and I see some of these family members that got roped into being in the business—I do not want hostage kids who got stuck with the family business and all of the nightmares that go along with that.

I made it clear: “Do not ever use the phrase, ‘Oh, Dad’s turning in his grave.’ Or, ‘He wouldn’t want us to do that.’ Do whatever you need to do to be happy.” That’s my message: Do whatever you have to. You want to sell the business, sell the business. You want to run the business, run the business. You want to blow it up…

I am not hanging this on my kids. I’m just not. And I’ve seen too many repercussions from it. And I’m not going to be the old man going, “I built this for you!” I’m not. I don’t want to do it. I’m not going to do it.

Jim Kalb:

Well, then you’re going to screw over your employees, because then the kids are gonna sell it to a PE company, or whoever wants to buy it from them. And they’re gonna walk away with the money, and then they’re going to—

Jay Goltz:

First of all, let’s go through that for a moment. You just kind of explained the whole thing. That is hardly screwing over my employees. This is where they crossed the line in every one of these seminars: I don’t believe any business owner owes it to their employees to give them shares of their company. Do I think it’s a nice, good thing? Absolutely. But I’m not getting on a soapbox to say, “We all owe it to our employees to make sure that they end up with a piece of the business.”

That’s why I was so offended by the guy who they chose to do the speech about it. Show me somebody who started the business, who had 40 years of stress and risk, blah, blah, blah. I don’t owe anybody anything. And I certainly want to do something for my employees. But I’m not hanging it on my kids. I’m just not. And if you gave me those two choices of: One is my kids end up with this legal nightmare of dealing with this monster I created, or they decide to sell it and take all the cash—

Shawn Busse:

You’re making a lot of assumptions about the legal nightmare. And I would encourage you to talk to some more mature ESOPs that have been around for a while and see what their experience has been, because I look at it and go, “This could be a win-win here.” You’re taking care of your employees. You’re also unsaddling your kids from a ton of responsibility.

Jay Goltz:

That’s just not true.

Shawn Busse:

They’re also getting a ton of wealth in the process.

Jay Goltz:

Wait, wait. Think about what you just said. Unsaddling? I leave a business with my kids and they’ve got an ESOP. That’s unsaddling? That’s hardly the case.

Shawn Busse:

They don’t have to run it.

Jay Goltz:

Everybody who I talk to, the experts that do this for a living, when I explained, “I only want to do 30,” so far, three out of three go, “Yeah, this doesn’t make sense for you.”

Shawn Busse:

Well, no, I’m advocating that you eventually get to 100 percent. Because unless these kids are really passionate about running the business… I mean, if they’re saying to you, “Dad, I love this business. I can’t wait to do it the rest of my life.” And I haven’t heard you say that at any point.

Jay Goltz:

No, no, here’s the math. I hope to be going to work for 20 years. My kids will be 60 years old, 55 years old. It’s like, I don’t know that I’m going to be able to get this going into the third generation, and like, that’s okay. I am not going to burden myself. I’ve had enough burden for 45 years. I am not going to burden generations of mine with having to keep this thing going. If it doesn’t work at some point, it doesn’t work at some point.

Shawn Busse:

So unburden them. Like, dude!

Jay Goltz:

They don’t have any burden now. They can do whatever they choose to do. That’s no burden.

Jim Kalb:

They’re going to get the money that you sell it for.

Loren Feldman:

Jay, I think they’re questioning whether it’s actually burdening them by doing an ESOP. And I think Shawn looks at it as unburdening them.

Jay Goltz:

Oh, I don’t know. If you talk to any one of these people, all you hear are the words “hard work,” “complicated.”

Shawn Busse:

Talk to the ESOPs, Jay.

Loren Feldman:

That’s not what Jim says.

Jim Kalb:

That’s not what I say at all.

Jay Goltz:

Here’s a problem: I can’t find anybody who sold 30 percent of their ESOP and had no plan—I haven’t been able to find that person.

Jim Kalb:

I’ve sold 12 percent so far.

Jay Goltz:

I know. But you’ve made it clear, you plan on retiring and being done and getting all the money out. Great.

Jim Kalb:

I have a plan to sell 100 percent someday, along the way. But right now, we’ve sold a grand total of 12 percent.

Jay Goltz:

And for you, it makes perfect sense. And then

Jim Kalb:

And in a couple more years, we’ll sell 18 more to get it to 30.

Loren Feldman:

Jay, he’s saying that it’s not that different from your situation.

Shawn Busse:

I think, Jay, you’re underestimating what it takes to run a business, in terms of the burden of running a business. I mean, even yourself, you’re like, “Hey, some of these businesses I have, they might not be valid in 10 years.” These are big things to carry.

Jay Goltz:

Right, which means that the best thing, possibly, in 20 years—keep in mind, my key managers will all be retired in 20 years, they’re all in their 40s—the best thing might be in 20 years to just shut the business, sell the real estate, and move on. That might be the best alternative for all parties.

Loren Feldman:

Jim, is there any reason he couldn’t do that if it were owned 30 percent by an ESOP?

Jim Kalb:

No, we could do that the whole way. And additionally, your key managers are gonna be 60 years old, but then you’ll have key managers replacing them. It’s a continuum. It’s not a snapshot of today. It’s going to be what happens.

I mean, we’ve got young kids who are coming into the business that I see them taking over the management of the company someday. It’s going to be there. But back to this whole thing. So, Jay, what you’re saying is, “I don’t want to burden my kids.” But what happens is—

Jay Goltz:

And myself. No, let me say that. Shawn really hit it on the head. Because Shawn’s very smart. I don’t need to be told what to do. I just don’t. After 45 years of me putting everything I got…

Loren Feldman:

Who’s going to tell you what to do, Jay?

Jay Goltz:

You’ve got the whole—every time I start hearing board of directors, trustees. I don’t need to deal with any of that.

Jim Kalb:

All you’re doing is saddling your kids to sell the company once you are no longer there. And at that point, whoever’s gonna buy it from them is gonna look at that and say, “Hey, lookit, Jay is not here to run this business anymore. So we’re gonna pay you a lot less money for this.”

Jay Goltz:

No, you left the part out that you brought up before that you forgot about. I’ve got so much inventory. I used to wonder why businesses just closed, and they didn’t sell. And now I realize people make enough money on going-out-of-business sales to make just as much money as if they sold the business. I have a ton of inventory. So my business is simply just not worth much more than the inventory. So this would not be a nightmare. This would not be a burden. At the end of the day, sell off the inventory and move on.

Jim Kalb:

And just close it down. And throw the employees out on the street.

Jay Goltz:

Umm I did not adopt them. I care about them. I want to do everything—and I can tell you, in my letter I put in there, “Give bonuses to blah, blah, blah.” I’m not buying that. If you want to buy that, go ahead. But I’m not taking that responsibility. I am not taking the responsibility for 130 people. They’re hardly thrown out on the street. They could go get other jobs. I would hope that doesn’t happen. But I am not buying that. I’m not taking that responsibility.

Jim Kalb:

Well, again, I look at it in a completely different way. And I know Shawn does too. And the fact is, I think you can talk about how much sweat and equity and how much sleepless nights you have. I’ve had those too, but some of my employees, a lot of them, have been with me long-term, just like your staff. And they have put up with the lean years.

They have got forsaken raises when they could have gotten jobs somewhere else for a lot more money. And they stayed with us the whole way. And so yes, they have put themselves out there. And in a sense, I want to reward them. They made the company what it is today. I’m not out there doing every job. I’m paying them. I’m paying myself.

Jay Goltz:

Let me cut to the chase: Did they sign a personal guarantee for $2 million to the bank?

Jim Kalb:

No, but they allowed me to pay off that guarantee.

Jay Goltz:

No, they didn’t. No they didn’t. So don’t tell me it’s the same thing. Because it’s just not. It’s just not. I’m not saying they’re not dedicated. I’m not saying I wouldn’t want to make sure that I take care of them as much as possible. But don’t tell me they’ve got as much skin in the game as the owner who has had to sign personal guarantees for years and years and years. I’m not buying that. And I don’t think they’re getting screwed over.

And I will make sure I put in the document, “Here’s what my wishes are: Blah, blah, blah.” No one would get screwed over is the point. I look at the alternative to this. There are so many moving parts to it. It’s simply not worth it. And what’s changed is, like I said, I figured out I can accomplish my goal by doing a good bonus plan through the 401(k) plan.

Shawn Busse:

Let’s just set aside the morality of whether employers are obligated to take care of their employees for their entire lives. I just think that’s an issue that raises the emotional level, and it distracts from the core issues here. And the argument I’m making is that I think Jay cares about his people. I think Jimmy cares about his people. I think I care about my people. We all recognize they have helped build the business. I think it’s a waste of time to start to say, “Well, I put in more energy than they did.” Or, “I signed my house,” or “I was up sleepless nights.” Let’s just set all that shit aside and say, “Hey, how can we do best for the people we care about and love?” That includes our family. That includes our employees.

And I think what Jimmy is showing is there’s a path forward to where the employees win in the short-term and the long-term. And the employer wins. Yes, maybe there’s a little bit of control you give up. But you’re going to give up that control regardless when you die. And I think there’s a really cool way in which this thing can last a long time.

And Jay, I think your heirs would make out really well. And I would encourage you to consider that this business you have built, which is clearly in your heart. Like, clearly you’re speaking so passionately for it because you have made it so much of who you are. You care about these people, and you don’t want them to become homeless. You’ve said it yourself. And I think there’s an opportunity—and maybe it’s not today, maybe it’s 10 years from now—to say, “My kids, actually, they don’t really want it. They’re not passionate about it. My employees, they do want it. And here’s a way for everybody to win.”

Jay Goltz:

I’m already there. There’s nothing you said that’s not true. I’ve already got that in place. And if the kids want out, and they want to do an ESOP, they can go do an ESOP at that point. And they can be the ones to set the ESOP up.

My only line in the sand is I don’t want to be preached to buy anybody that I have some moral responsibility to make sure that all of my employees work at this company for the rest of their lives. That’s where I draw the line.

Shawn Busse:

We can take that out of the conversation. I think that’s a waste of energy, because it’s just going to fire owners up and get them all upset. I think what I’m looking at is, “How do we create a win for everybody here?” And I think that’s an interesting idea—just say to your children, “Hey, if you guys don’t want to run this, and I’m not around anymore, here’s the path, please set up an ESOP.”

Jay Goltz:

I did that. That’s exactly what I did. I typed out a whole sheet with, “Here’s the bonuses I want all the people to get, you can afford it.” I’ve laid all that out. And it’s all there in black and white, and they will follow it. They will do it.

Loren Feldman:

Well, we are just about out of time.

Jim Kalb:

One last thing, Jay, is that your heirs, if they do sell it to a PE company at the end or that they liquidate, they will pay the full tax.

Shawn Busse:

So many taxes.

Jim Kalb:

So many taxes on that. Whereas they would avoid paying those taxes on the sale. It would be deferred into your trust, until at which time they actually sell the investments.

Jay Goltz:

There’s no question. But that gets back to, I’m in a weird business with four different businesses. And the one guy who knows it says, “Jay, you’re gonna have a real hard time getting a good valuation.” Because I’m a weird business. Is it possible that there’s someone in my situation who could walk me through this and go, “Oh, no, this is”—maybe. Maybe that person exists. I haven’t met him.

Loren Feldman:

And if they’re listening, reach out to me, loren@21hats.com. And I’ll put you in touch with Jay.

In any case, my thanks to Shawn Busse, Jay Goltz, and Jim Kalb, and of course to our sponsor, the Great Game of Business, which helps businesses implement open-book management and employee ownership. Hopefully no one there will listen to this episode. You can learn more at greatgame.com. Thanks, everyone.