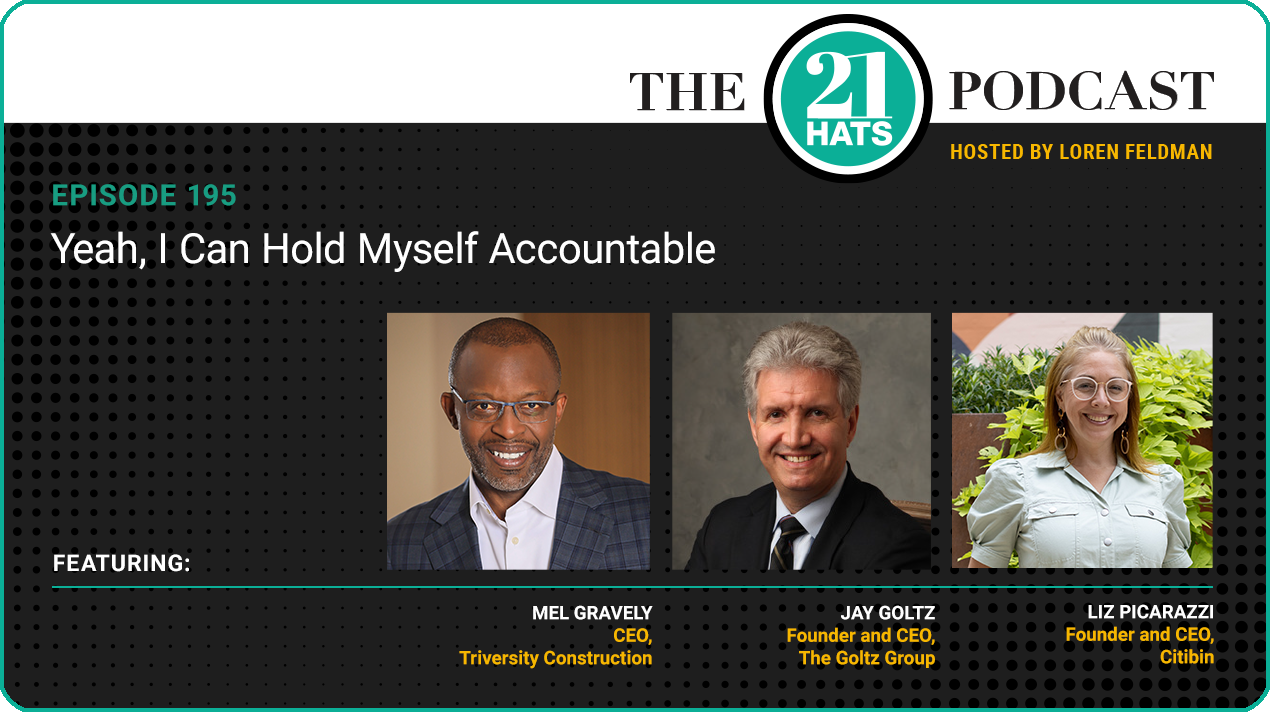

This week, Mel Gravely tells Jay Goltz and Liz Picarazzi about his recently executed succession plan, including what’s worked and what could have gone better. The main thing that could have gone better, Mel says, is his purchase of another small business where he says he misdiagnosed the challenges the business is confronting: “I thought they just had a bad model and they weren't managing it well. It was worse.” All of which leads to a discussion of the role that a board of advisors can play in helping an owner build a business. While Mel has said he wouldn’t run a lemonade stand without a board, Liz and Jay—like most business owners—have taken a different approach. The notion of having a board of advisors, Jay tells us, is something he struggles to get his head around. “I’ve been doing this for 45 years,” he says, “and I’ve never had anybody to answer to.” Plus: with the talk of tariffs getting louder, Liz updates us on her search for an alternative to manufacturing her trash enclosures in China. “We really have to have a Plan B,” she says. “We'd be stupid not to have a Plan B.”

This week, Shawn Busse, Jay Goltz, and Jaci Russo talk about the new rules that may—or may not—ban non-compete clauses, increase the number of employees who must be paid overtime, and eliminate TikTok in the U.S. How much would those changes matter to each of their businesses? What might the owners do differently? Do the changes make sense? And why does it so often seem as if it’s small businesses that get caught in the cross-fire when the government tries to rein in abusive big businesses? On the question of non-competes, Shawn says he thinks they are often used by lazy businesses that haven’t done the real work of building loyalty with employees and customers. Plus: Do Shawn, Jay, and Jaci ever regret starting a business? Have there been times when they’ve thought about packing it in and trying something else? And also, are the terms “business owner” and “entrepreneur” interchangeable? Or do they carry different connotations? Might there be a better term? Jay thinks there is.

The wrong way to make innovation happen, Ty Hagler says in this week’s special bonus episode, is to have a great idea and then go all-in trying to create it. That, he says, is a really expensive way to find out if your idea works. The right way to pursue innovation, he says, is to take your idea to customers so you can assess the pain points and opportunity spaces before proceeding. Hagler, who is founder and CEO of Trig, an innovation and design firm in North Carolina, also says he’s learned that the problem with focus groups is that the more people you have in the room, the less valuable the conversation tends to be. In fact, he says, one-on-one is best. He also says that brainstorming remotely can actually work better than in-person. Oh, and by the way, if your Mom tells you she loves your idea and will definitely buy your product as soon as it’s available, she’s probably lying.

This week, Sarah Segal takes Paul Downs and Jay Goltz through her recent QuickBooks nightmare. Right before tax season, Sarah ran her P&L, and it showed a profit of $250,000—but she knew right away that that couldn’t be right. It then took a bookkeeping SWAT team to figure out what exactly had gone wrong. “I was literally on the verge of tears,” Sarah tells us. “How am I going to do this and not be late on filing my taxes? And credit to this woman, who, I swear to God, was like my therapist and my bookkeeper. She was like, ‘Don't worry, Sarah. We're going to figure it out.’” Which they did—and which brings an important reminder: Not every dollar that comes in the door should be counted as revenue. Plus: What do you do when a new employee isn’t working out? When is the right time to intervene? Do performance improvement plans actually work? Are grace periods a good idea? Also: Jay emphasizes a little understood reason why it can be important to fire fast. And Paul explains what he likes about the AI search engine Perplexity.

This week, special guest Jenelle Etzel, who majored in weaving, tells Shawn Busse, who majored in ceramics, why she believes attending art school and managing a punk rock band were perfect preparation for building a thriving real estate business. Her agency, Living Room Realty, has 130 brokers, roughly $5 million in revenue, and a market position that stands out among the big boys. While she once considered business a dirty word, she has embraced entrepreneurship and learned lots of important lessons, mostly through trial and error. For one, she figured out that there was a segment of the housing market—or the potential housing market—that more traditional brokers were ignoring. She also figured out, somewhat counterintuitively, that her real customers aren’t the people who buy and sell homes. Her real customers, she says, are her brokers, who happen to be independent contractors: “I can't tell anybody what to do,” Jenelle tells us. “So it's like being a politician, in a way. I've got a lot of responsibility with very little authority, and that's an interesting leadership challenge.”

This week, Liz Picarazzi, Jaci Russo, and Laura Zander talk about what it’s been like building a business in partnership with a spouse, and they all agree on some important things. For one, they all say that, had their husband been just another employee, he probably would have been fired. All three say that in their relationships, they are the gas that drives the business, and their husband is the brake that sometimes keeps them out of trouble and sometimes frustrates their entrepreneurial instincts. And all three agree that some things are best left undiscussed. For example, says Jaci: “Michael doesn’t even know what we make. He also doesn't know what any of the employees make.” But the three CEOs also agree on this: In the final cost-benefit analysis, they wouldn’t want to build a business any other way.

This week, Jay Goltz tells Shawn Busse and Jaci Russo that, while he’s always been good with numbers, he’s never really enjoyed tracking his finances. It’s not what drove him to start a business, and over time, he stopped paying close attention. But now, after seeing his inventory levels and some big expenses get out of control, he’s diving back into the numbers and pretty much serving as his own chief financial officer, something he says he should have been doing all along. Plus: Shawn explains how one book and a specialized accounting firm and a monthly routine have gotten him comfortable with his numbers. And Jaci says it took years for her to learn to ignore the accountants who always gave her the same advice: Cut expenses. Instead, she tells us, “We've spent the past probably eight years really right-sizing what we charge. And now I feel like I can breathe.”

This week, Paul Downs, Jennifer Kerhin, and Liz Picarazzi discuss the challenges couples face when one spouse is building a business. Liz says it was important to let her husband know that she spent years working on a business plan before leaving her corporate job to start her first business. Paul explains why, when times have been tough, he hasn’t always shared the bad news with his wife. And Jennifer says too many couples planning for one spouse to start a business focus on best-case scenarios rather than the more likely worst-case scenarios. She also suggests some important questions for couples to ask themselves, including this one: “Will she still have faith in him if the business fails?” Plus: Businesses fail all the time, of course, and Paul explains why he thinks it’s usually for one of three reasons. And four years after the pandemic arrived, we take a look back: What was each owner’s toughest moment? What was their best decision? How have their business models changed?

This week, we offer you a taste of the 21 Hats Live event we held in Fort Worth two weeks ago. It’s a different kind of event where there are no speakers, only participants. It’s pretty much a three-day, peer-group session for business owners, where we share challenges and insights and make connections. There were 25 of us, including most of our podcast regulars.

For me, the highlight was an exercise that Chris Hutchinson of the Trebuchet Group facilitates. He calls it a “Fish Bowl” because the idea is to have an owner stand up and expose everything about a specific challenge that he or she is confronting. Fortunately, we had one owner who was gracious enough to agree to reveal all, to answer any question. And that owner was, well, it was me, actually. The truth is, this was a priceless opportunity for me to get some feedback from a focus group of smart entrepreneurs who were already familiar with 21 Hats.

It even got a little emotional, mostly because a couple of the owners were kind enough to say that, had it not been for 21 Hats, their businesses might not have survived the pandemic. That was moving to hear, to say the least, but of course, that alone doesn’t mean 21 Hats has a sustainable business model. We recorded the whole thing, and if you have any thoughts after listening to it, please send them my way.

This week, Matt Hoying, president of Choice One Engineering, explains to Shawn Busse and Jay Goltz how he created a DIY employee-ownership plan for his firm. Some 10 years ago, Matt’s predecessor as president tasked him with selecting an ownership structure that would engage employees and help Choice One be as successful as possible. That sent Matt on a mission of discovery in which he researched the pluses and minuses of every structure he could find—including employee stock ownership plans—before ultimately creating his own structure. Matt’s plan doesn’t enjoy the tax advantages of an ESOP, but it’s open even to part-timers, and it requires employees who want to be owners to make a financial investment in the business. In other words, they aren’t given ownership; they have to buy into it. Shawn and Jay quiz Matt on the choices he made and how the plan has worked out.